What is Simplified Issue Life Insurance?

Simplified issue life insurance is a final expense policy that you can be approved for by answering minimal health questions. A traditional life insurance policy asks for a more in-depth health analysis which sometimes can make approval difficult.

Topics Covered in this Article

What is Simplified Issue Life Insurance?

Life insurance companies use a process called underwriting to gather info on applicants to determine how much risk they are to insure and how much premium should be charged.

When you apply for traditional life insurance, carriers usually require you to answer a long health questionnaires with 50 or more questions and usually require an exam.

This process could take up to 60 days or more depending on what information the insurer asks for. Insurance companies soon realized that many people didn’t like and wouldn’t go through such a lengthy process. This is when insurance companies decided to streamline the process by introducing simplified issue life insurance.

As the name suggests, simplified issue insurance is the simplest form of underwriting. Simplified issue life insurance is a whole life policy that comes with a guaranteed death benefit, guaranteed premium, and guaranteed cash value accumulation. These types of policies do not expire like term life insurance.

Simplified issue life insurance offers immediate coverage, unlike guaranteed issue life which has a 2 year waiting period.

An exam is not required for simplified issue life insurance. Insurers use third party vendors to gather information such as prescription drug history and motor vehicle records. Some companies require a phone interview to complete the process. The decision on whether you are approved or not usually takes 3-5 business days but you could no immediately.

What health questions are asked?

Each company varies on the exact type of health questions asked and how many are asked but here are some of the common ones:

- Is the Proposed Insured currently receiving health care at home, or requires assistance with activities of daily living such as bathing, dressing, feeding, taking medications or use of toilet, etc?

- Is the Proposed Insured currently in a Hospital, Psychiatric, Extended or Assisted Care, Nursing, Prison or Correctional facility?

- Has the Proposed Insured ever tested positive for the HIV virus or been diagnosed by a member of the medical profession as having AIDS or the AIDS Related Complex (ARC)?

- Has the Proposed Insured ever tested positive for or been diagnosed by a member of the medical profession as having Alzheimer’s or Dementia, Cirrhosis, Emphysema or Chronic Obstructive Pulmonary Disease (COPD)?

- Has the Proposed Insured in the past 12 months been advised by a physician to be hospitalized or to have Diagnostic Tests, Surgery, or any medical procedure that has not yet been completed or for which the results are not yet available?

- Has the Proposed Insured in the past 24 months been diagnosed as having or advised by a physician to have treatment for Cancer (other than Basel Cell Carcinoma), Heart Attack, Stroke or TIA (Transient Ischemic Attack), Alcohol or Drug Abuse?

- Has the Proposed Insured in the past 24 months had a Driver’s License revoked or suspended, or been convicted of two or more moving violations, or been convicted of a violation for driving while intoxicated or under the influence, or for driving while ability impaired because of the use of alcohol and/or drugs?

- Has any Proposed Insured ever been declined, postponed, rated, or modified for insurance?

- Within the past seven years, has any Proposed Insured been convicted of, pleaded guilty to, or entered a plea of no contest to any felony?

- Is any Proposed Insured currently on probation or been placed on probation within the last 12 months?

- Has any Proposed Insured had a driver’s license suspended or revoked within the last five years?

- Has any Proposed Insured been convicted of reckless driving or driving under the influence of alcohol or drugs in the past five years?

- Have you been told you have a terminal medical condition or end stage disease of any type expected to result in death within the next 24 months?

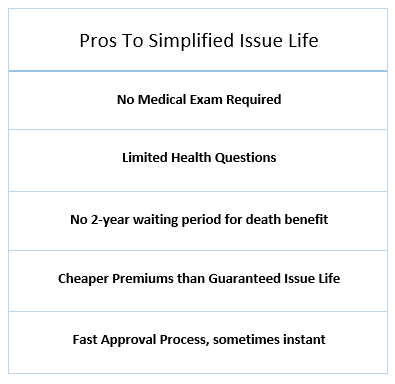

The Pros’ of Simplified Issue Insurance

Being able to purchase a policy without a medical exam and being approved within days are the top reasons consumers choose simplified issue life insurance.

Other pros’ to simplified issue insurance is NO 2 year waiting period on death claims for natural causes and premiums are less expensive than guaranteed issue life. Simplified issue life insurance is also good if you are just trying to cover end-of-life expenses, such as funeral costs.

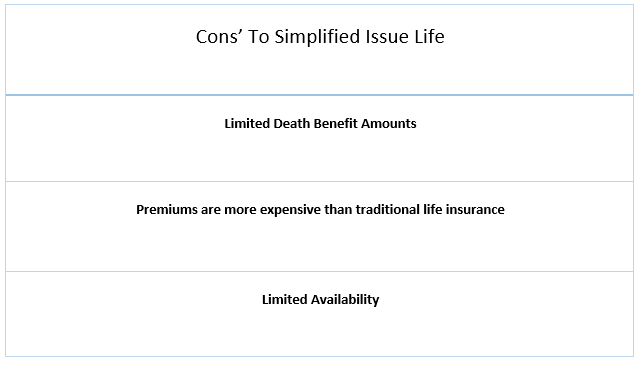

The Cons’ of Simplified Issue Life Insurance

The major drawbacks to simplified issue insurance are the costs and limited amounts of coverage that you can buy. Most of these policies are limited to $25K-$50K of coverage. Premiums also tend to be higher than a traditional life insurance policy.

Simplified issue life insurance is not a product that alot of insurance companies carry, so finding a company who does can require more effort. And most of the insurance companies that do sell these types of products, you may not have heard of.

Should I buy a Simplified Issue Life?

Simplified issue life insurance can make sense for some consumers. Candidates for this product would be:

- Those looking to avoid an exam

- Those looking for coverage immediately

- Those wanting to skip the lengthy underwriting process

- Those with pre-existing health conditions that keep them qualifying for traditional life. insurance

If you fall into these categories then simplified issue life insurance may be the solution.

The Best Simplified Issue Life Insurance Companies

Below is a list of who we think are the best simplified issue life insurance companies to work with. We based our picks based on their financial ratings, premium costs, and customer service. If you see a company that is not on our list, let us know and why you like them.

Mutual of Omaha (MOO)

Mutual of Omaha Life Insurance or MOO has been offering insurance products for over 100 years and prides itself on excellent customer service and innovative products.

Mutual of Omaha boasts strong financial ratings with all 3 rating agencies. Look below:

- “A+” Superior Rating with A.M. Best

- “AA-” Very Strong Rating with S&P

- “A1” Good Rating with Moody’s

MOO offers a simplified issue whole life policy (called the Living Promise) with lenient underwriting. This helps seniors with health issues qualify for affordable coverage.

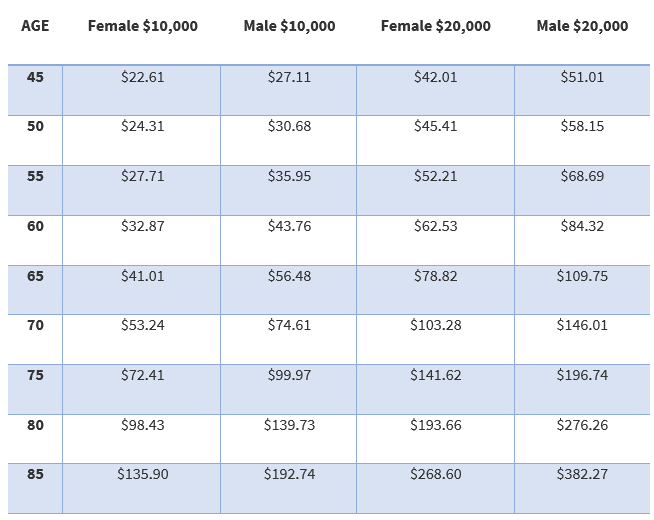

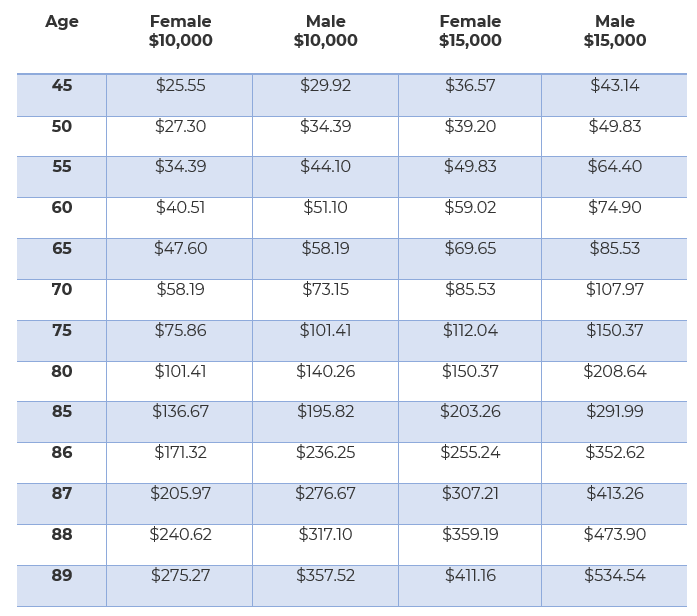

The Living Promise offers death benefits that range from $2K-$40K to consumers age 45-85 years old. This policy also comes with day 1 coverage, no waiting period. Look below for sample quotes:

Royal Neighbors of America (RNA)

Royal Neighbors of America or RNA was founded in 1895. RNA boasts an A.M. Best rating of an “A”.

RNA offers a simplified issue whole life with death benefit amounts between $7K-$30K. No exam is required and issue ages are between 50-80 years old. This product is available in all 50 states except for AK, AL, HI, LA, MA, NH, and NY.

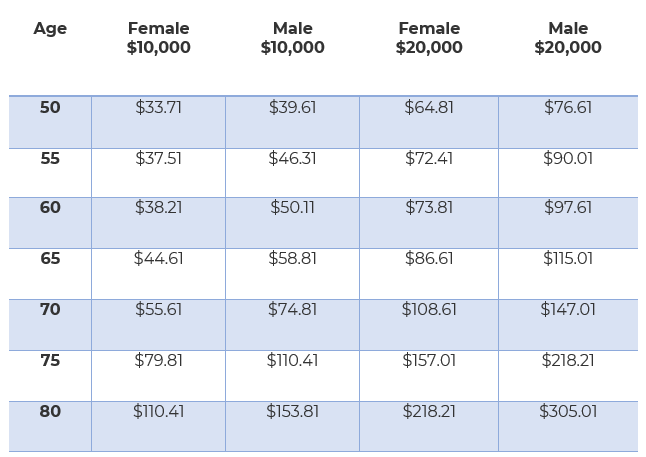

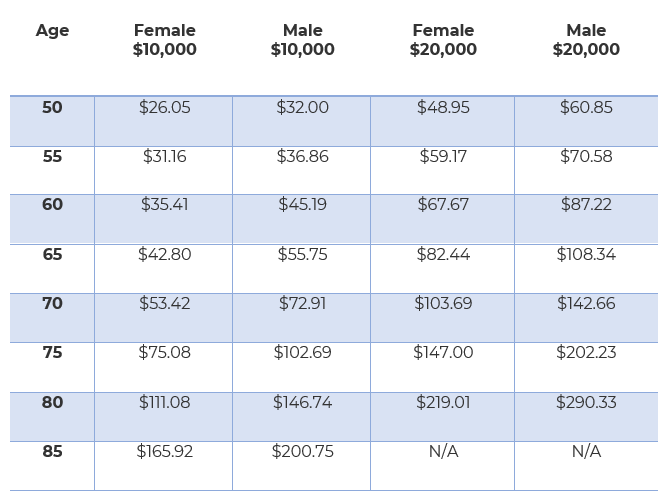

Check out the rates for RNA’s simplified issue whole life below:

Aetna

Aetna was founded in 1853 and currently has an “A” rating with A.M. Best Ratings. Aetna offers coverage for consumers age 45-89 and is one of the only insurance companies that offers coverage past the age of 85.

Death benefits for Aetna’s simplified issue whole life policy is $2K-$50K (varies by age). They offer coverage in all 50 states except NY. Aetna’s final expense policy also comes with day 1 coverage pending underwriter approval.

Foresters Financial

Foresters Financial was founded in 1874 and holds an “A” rating with A.M. Best. Foresters, as a company, is heavily involved with charity work throughout the United States. Foresters simplified issue life insurance is called the PlanRight level benefit.

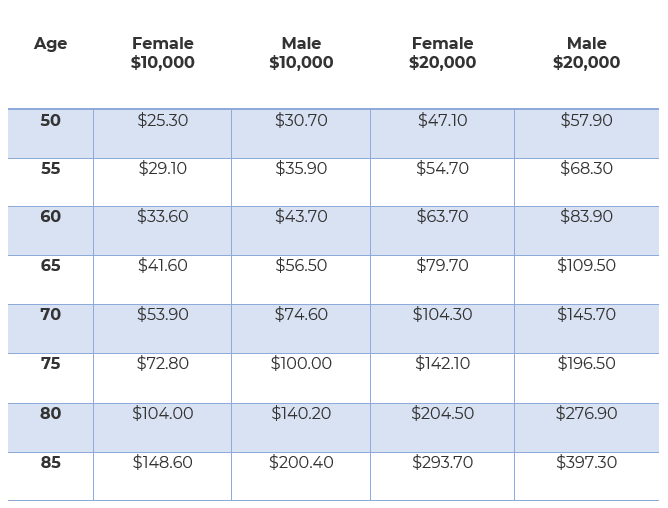

The PlanRight offers coverage between $5K-$35K with an applicant age range of 50-85 years old. The PlanRight also comes with day 1 coverage pending underwriter approval. Check out the rates for the PlanRight simplified issue from Foresters below:

Transamerica Life

Transamerica Life Insurance Company is a name you probably have heard of. They were founded in 1904 and have an “A” rating with A.M. Best. The name of there simplified issue life insurance is the Immediate Solution.

The Immediate Solution offers no exam and you can qualify for a preferred class, depending on your health. This policy is offered to consumers age 45-85 with death benefits up to $50K. There is no 2 year waiting period on death claims also. Check out rates for the Immediate Solution below.

Our thoughts on Simplified Issue Life

If you have been declined coverage for traditional life insurance due past health problems, then simplified issue life insurance could be your answer. It’s important to work with an independent life insurance agent who has access to multiple companies. This will ensure you ge the best coverage and rate for you unique situation. Thanks for taking time to read this post and let us know if you have any questions.