What Is Final Expense Insurance?

Final expense life insurance, or burial insurance is a simplified issue whole life policy that provides coverage to pay for end-of- life expenses such as medical care, funeral costs, or small debts. Final expense insurance will be more expensive than term life insurance, but does last for your entire life.

Topics Covered in this Article

Final expense life insurance is designed for seniors who don’t have dependents anymore or necessarily need a lot of life insurance for income replacement. However, there is still one need that seniors will always have, and that is funeral costs.

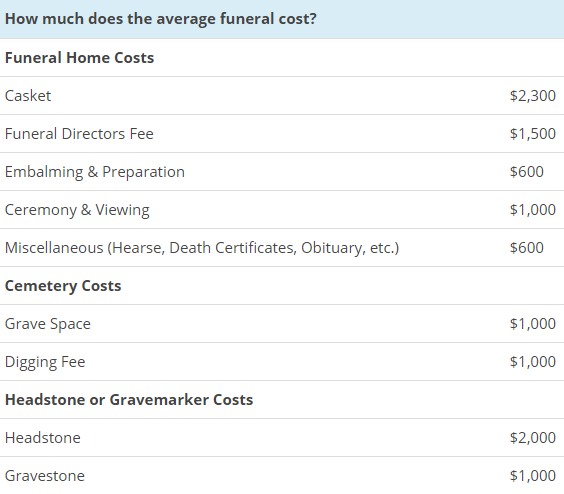

Depending on where you live, funerals can cost anywhere from $8,500-$12,500. This doesn’t include any other end-of-life expenses such as medical bills. These bills can end up becoming a financial burden on your loved ones.

This is where final expense or burial insurance could be an option. If you are searching for life insurance protection that will cover the cost of end-of-life expenses, then final expense insurance could be right for you. Final expense life insurance is best suited for people who don’t qualify for traditional coverage.

What is Final Expense Insurance?

Final expense insurance or sometimes referred to as burial insurance is permanent life insurance intended to cover funeral expenses. The death benefit can also be used to pay for end-of-life expenses such as final medical bills.

Like other permanent life policies, burial insurance lasts forever and cannot be canceled as long as the premiums are paid. Other traditional permanent life insurance usually require an exam to be completed before approved, but final expense life insurance does not. All you need to do is answer a few health questions to qualify.

Final expense insurance has limited death benefits and is offered to consumers age 45-85 depending on the life insurance company.

Types of Final Expense Life Insurance

Final expense life insurance offers 3 types to choose from:

- Simplified Issue Life

- Guaranteed Issue Life

- Graded Life

Simplified Issue Life

Simplified issue whole life insurance is great for people who may have had health problems that disqualified them from a traditional life insurance policy. You will have to answer some medical questions and be able to answer them “no” in order to be approved.

Simplified issue life comes with:

- Day 1 coverage (no 2 year waiting period)

- Level premiums

- Cash value accumulation

- Death Benefits up to $50K

- Lifetime coverage

Guaranteed Issue Life

Guaranteed issue life insurance policies offer instant approval no matter your health situation. These types of polices are considered a last resort for consumers who have been declined for traditional and simplified issue life insurance.

Guaranteed Issue Life Insurance offers:

- 2 year waiting period on death caused naturally. Immediate death benefit for accidental death.

- Death benefits range from $5K-$25K.

- Level premiums

- Cash value accumulation

- No one is turned down

Graded Whole Life

Graded Life is very similar to the guaranteed issue life in that there is also a 2 year waiting period for claims on natural deaths. While guaranteed issue life asks no health questions, graded whole life does ask few knockout questions, such as are you terminally ill or if you are confined to a nursing home. Graded life offers:

- 2 year waiting period on death caused naturally. Immediate death benefit for accidental death

- Death benefits range from $5K-$25K

- Level premiums usually cheaper than a guaranteed issue life

- Cash value accumulation

How Much Does Burial Insurance Cost?

The cost of burial insurance will vary based on your overall health, age, gender, state of residence, amount you buy, and the life insurance company you choose. While all burial insurance function similarly except for the price. Life insurance companies will vary with price, so it’s important to work with an independent agent.

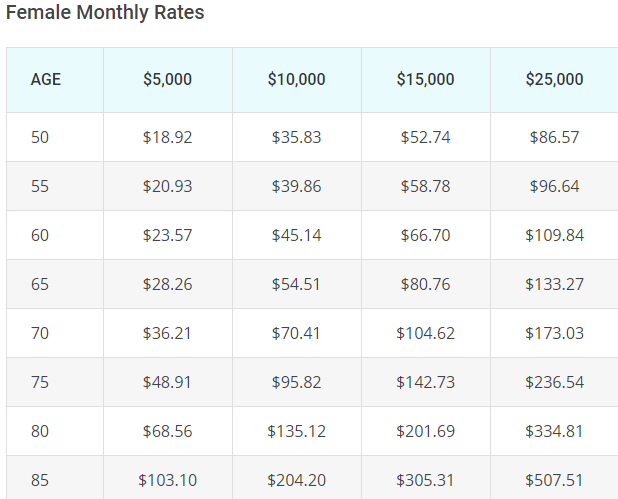

To give you an idea of what it would cost, we have provided some burial insurance quotes below:

The Best Final Expense Insurance Companies

Below is a list of final expense life insurance companies that we think have the best final expense products, premiums, and ratings. This is our opinion only and these companies may not fit your unique situation.

Mutual of Omaha

-

Company Started in 1909

-

Product name: Living Promise

-

Death benefit option: $2K-$40K

-

Age Range: 45-85 years old

-

No waiting period subject to underwriting

-

A.M. Best Rating: A+ (superior)

The Mutual of Omaha Living Promise has some of the lowest rates on burial insurance for seniors. Mutual of Omaha Living Promise doesn’t require an exam but does ask health questions.

Unless you have had recent heart attacks, strokes, cancer, etc. you will probably qualify for the Living Promise with Mutual of Omaha.

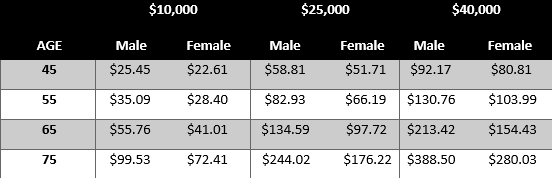

Mutual of Omaha Rates

Transamerica Life

- Company Started in 1904

- Product Name: Immediate Solution

- Death benefit option: $5K-$50K

- Age Range: 0-85

- No waiting period subject to underwriting

- A.M. Best Rating: A (excellent)

Transamerica Life is a household name when it comes to life insurance.

The Immediate Solution provides a lifetime guaranteed premium, guaranteed cash value accumulation and death protection coverage starting day 1. Consumers with overall good health are good prospects for the Immediate Solution.

Issue ages are from 0-85 with the maximum face amount decreasing the older you are. The Immediate Solution comes with the Accelerated Death Benefit and Nursing Home Benefit Rider at no extra charge.

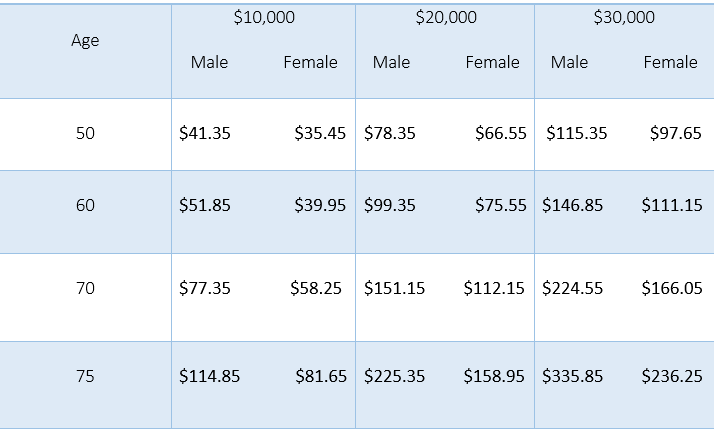

Transamerica Life Rates

Royal Neighbors of America

- Company Started in 1895

- Death benefit option: $7K-$30K

- Age Range: 50-75 years old

- No waiting period subject to underwriting approval

- A.M. Best Rating: A (excellent)

Royal Neighbors of America probably is a life insurance company that you may not have heard of, but don’t let that fool you. They are trustworthy and financially sound.

They are favorable to seniors with diabetes, past heart issues, and even past instances of cancer. They are priced right in line with other well know final expense insurance companies.

Royal Neighbors of America Rates

American Amicable

- Founded in 1910

- Death Benefit Option: $2,500-$35K

- Age Range: 50-85 years old

- No waiting period subject to underwriting approval

American Amicable may not be the best pick for someone that is fairly healthy, but they do have there niche.

If you have mental health issues such depression, anxiety, schizophrenia, or bipolar you can still qualify for great rates and first day coverage.

American Amicable has some of the lowest tobacco rates and rate pipe/cigar users at non tobacco. That could save you about 40% on your monthly premium.

American Amicable is a strong carrier and great choice for many.

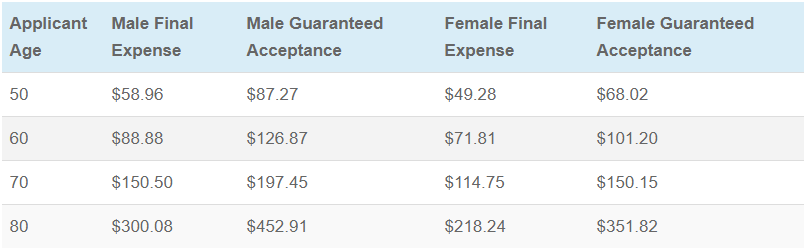

American Amicable Final Expense Rates

AIG

- Founded in 1919

- Death Benefit options: $5K-$25K

- Age Range: 50-80

- 2 year waiting period

- A.M. Best Rating: A (excellent)

- Guaranteed Acceptance

AIG final expense policy is a guaranteed issue whole life plan. That means everyone is accepted and no health questions are asked.

There is a 2 year waiting period for claims caused by natural death. Claims will be paid for accidental deaths the first 2 years. The full death benefit is paid after 2 years.

Purchasing a guaranteed policy is not the best choice for most seniors, but maybe there only choice there health will allow. AIG is a great choice if you have to go the guaranteed issue way.

AIG Guaranteed Issue Rates

Do You Need Final Expense Insurance?

If you are over the age of 45 and don’t have enough in savings to pay for you end-of-life expenses or funeral costs, then burial insurance would be a perfect fit. Since death benefits for burial insurance tend to be smaller amounts, the premiums usually are more affordable for the consumer on a fixed budget.

The great thing about final expense life insurance is that it is permanent life insurance. You lock your premium in at purchase and have the protection forever. It can never be canceled or have your premium increase.

5 Reasons to Purchase Final Expense Life Insurance

Final Expense Life Insurance might be the coverage you are looking for. Here of the 5 reasons to why you should consider purchasing a final expense policy:

LIFETIME PROTECTION:

Final Expense Insurance is a permanent whole life policy with a guaranteed premium and death benefit. They also build up cash value that can be borrowed if a need arises.

BURIAL EXPENSES & DEBT:

If you plan properly, a final expense policy could be used to pay for burial expenses or debts that remain after you pass away. Having debt pass on to your loved ones can be a financial burden during a time of mourning.

NO MEDICAL EXAM REQUIRED:

The convenience of not having to do a medical exam to qualify for final expense insurance is the feature like by most consumers. No needles, no urine samples or having to answer awkward questions to a stranger.

QUALIFYING IS EASIER:

Final Expense Insurance offers 3 types of coverage that provide a solution for all consumers when it comes to life insurance coverage. Whether it’s level, graded, or guaranteed issue coverage, their is no health condition that won’t qualify for one of these options.

FAST APPROVAL:

Since no exam is required and the applications are simplified issue or guaranteed issue, approval is fast. Most approvals happen within a week while it can be as fast as 24 hrs. depending on the carrier and the type of coverage chosen.

How to qualify for immediate coverage?

Qualifying for immediate coverage with a final expense policy will be easier than a traditional life insurance policy. While they do ask health questions, they are more lenient with there underwriting. Below is a sample list of the health questions asked.

This is just one company and the companies will vary.

The questions below are considered “knockout questions”, meaning if you answer yes to any then you would not qualify for immediate coverage.

- Are you in the hospital or bedridden?

- Are you in hospice, home healthcare, or a nursing home?

- Do you have any pending surgery or organ transplant

- If you have been diagnosed with any of the following:

- Dementia

- Alzheimer’s

- Down Syndrome

- Lou Gehrig’s Disease (ALS)

- Sickle Cell Anemia

- Cystic Fibrosis

- Cerebral Palsy

- AIDS, ARC or HIV

- Have you ever been in a diabetic coma?

- Do you have less than a year to live?

End-of-Life Insurance Tips

Plan Ahead

It’s important to take the time to understand funeral costs in your area. Usually any funeral home in your area can provide a price list to give you an idea of what a funeral will cost. Make sure the person that will be in charge of your final affairs has a copy of all your important documents.

You may want to share you final wishes with them also, such as flowers you want, what passages you want read, and songs you want played. Look, I understand no one likes planning there funeral, but having this laid out will save your loved ones a lot of stress.

Be Honest

If you do decide to purchase a final expense policy, the most important thing to do is answer the questions truthfully. Anything that you aren’t truthful about could cause your benefit to be denied.

Just because final expense insurance doesn’t require an exam doesn’t mean the insurance company will never know. Companies often order years’ worth of medical records when their insured dies during the policy’s contestability period. If there are any discrepancies between the answers on the application and the medical records, the claim is often denied. So don’t lie, it’s not worth the risk.

Review Your Coverage Often

With funeral costs rising and your health changing as you get older, it’s important to review your coverage to make sure you have enough to protect your loved ones. Reviewing your coverage also ensures you have the beneficiary or beneficiaries that you want.

How Do I Buy Final Expense Insurance?

It doesn’t matter what type of product you are buying, it’s better to compare offers from multiple companies before committing to one. The same is true when shopping for affordable burial insurance.

There are many websites, including this one where you can get quotes from multiple companies. Doing your own research will give you a good sense of what coverage will cost.

After you have done your own research, it will be best to work with an agent that specializes in burial insurance plans. This will ensure that you get the best policy for your unique situation. If you have any questions please don’t hesitate to contact us.