Graded Whole Life Insurance: A Senior’s Complete Guide for 2025

If you’re over 65 and looking for life insurance, you’ve probably discovered something frustrating: getting approved isn’t as easy as it used to be. Maybe you have diabetes, high blood pressure, or other health conditions that make traditional life insurance seem out of reach. Or perhaps you’ve been turned down by insurance companies in the past.

Here’s the good news: graded whole life insurance exists specifically for people in your situation. It’s a type of permanent life insurance designed for seniors and individuals with health issues who want to leave something behind for their loved ones or cover final expenses.

In this guide, we’ll walk you through everything you need to know about graded whole life insurance in plain English. We’ll explain how it works, what it costs at different ages, and help you decide if it’s the right choice for your situation. Think of this as a conversation with a trusted friend who wants to help you make an informed decision about protecting your family’s future.

What Is Graded Whole Life Insurance?

Graded whole life insurance is a type of permanent life insurance that’s specifically designed for people who have health issues or can’t qualify for traditional life insurance. The “graded” part refers to how the death benefit works during the first few years of the policy.

Unlike regular whole life insurance where your beneficiaries receive the full death benefit from day one, graded whole life insurance has a waiting period—typically two to three years. During this graded benefit period, if you pass away from natural causes, your beneficiaries don’t receive the full death benefit. Instead, they receive a return of all premiums paid plus interest, or a percentage of the full benefit.

Here’s what makes it different from other types of insurance:

No Medical Exam Required: You won’t need to get blood work, urine tests, or undergo a physical examination. This makes it accessible for seniors with health conditions.

Simple Health Questions: Most graded whole life policies only ask a few basic health questions—typically 3 to 5 questions about serious conditions like cancer, heart attack, or stroke within the past year or two.

Guaranteed Acceptance (Usually): As long as you fall within the age range (typically 50-85) and answer the health questions honestly, you’re virtually guaranteed to be accepted.

Permanent Coverage: Unlike term insurance that expires after a set period, graded whole life insurance lasts your entire lifetime as long as you pay your premiums.

Fixed Premiums: Your monthly payment stays the same for life—it will never increase, even as you get older.

Cash Value: A small portion of your premiums goes into a cash value account that grows slowly over time, which you can borrow against if needed.

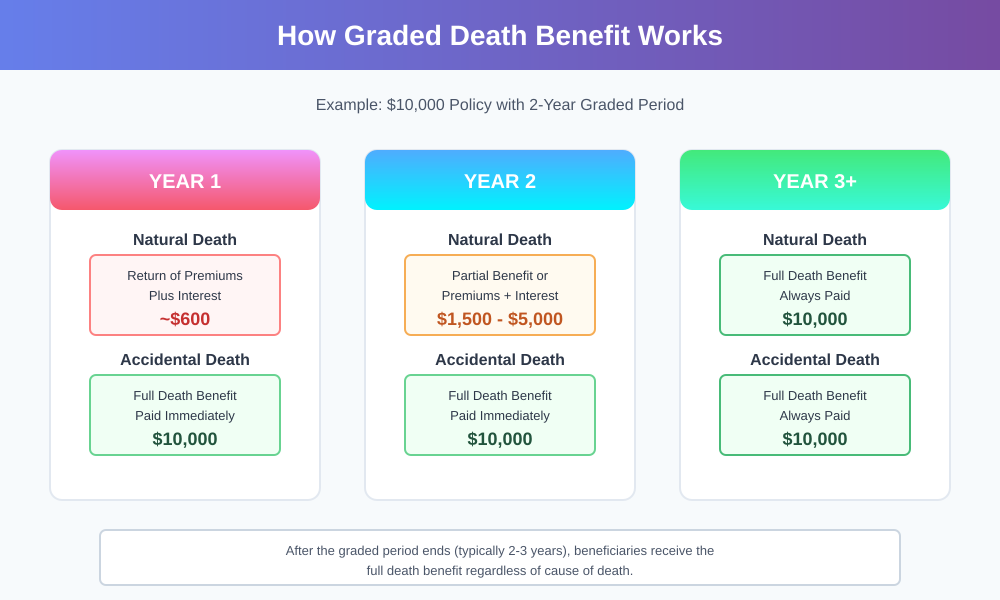

How the Graded Death Benefit Works: A Timeline

Understanding the graded benefit period is crucial, so let’s break it down with a clear example.

Let’s say Margaret, age 70, purchases a $10,000 graded whole life insurance policy with a two-year graded benefit period. Here’s what happens:

Year 1 (Months 1-12): If Margaret passes away from natural causes during the first year, her beneficiaries receive a return of all premiums paid plus 10% interest. If she paid $50 per month for 8 months, they’d receive approximately $440 ($400 in premiums + $40 interest). However, if she dies from an accident, they receive the full $10,000.

Year 2 (Months 13-24): During the second year, some policies increase the benefit to 50% of the death benefit for natural causes (in this case, $5,000), while others continue to return premiums plus interest. Accidental death still pays the full $10,000.

Year 3 and Beyond (Month 25+): After the graded period ends, Margaret’s beneficiaries receive the full $10,000 death benefit regardless of whether she dies from natural causes or an accident. This full benefit remains in effect for the rest of her life.

Important Note: The graded benefit period only applies to death from illness or natural causes. Death from an accident typically pays the full benefit immediately, even during the graded period.

Who Needs Graded Whole Life Insurance?

Graded whole life insurance serves a specific purpose and works best for certain situations. You might consider this type of policy if:

You Have Health Issues: If you have diabetes, high blood pressure, heart disease, COPD, or other chronic conditions, graded whole life insurance offers coverage when traditional policies might reject you.

You’ve Been Declined Before: Many seniors have been turned down by other insurance companies. Graded whole life provides a second chance at coverage.

You Want to Cover Final Expenses: Funerals, burials, and end-of-life medical bills can cost $7,000 to $15,000 or more. Graded whole life ensures your family won’t bear this financial burden.

You Want to Leave a Small Inheritance: Even a modest policy of $5,000 to $25,000 can make a meaningful difference to your children or grandchildren.

You’re Between Ages 50-85: This is the typical age range for graded whole life insurance policies.

You Don’t Qualify for Guaranteed Issue: While similar, graded whole life typically offers slightly better rates than guaranteed issue policies because of the basic health questions.

You Can Afford the Premiums: Since you’ll pay these premiums for the rest of your life, make sure they fit comfortably in your budget.

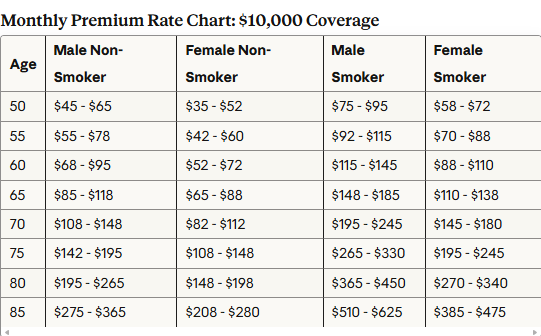

Graded Whole Life Insurance Costs: Rate Charts by Age

One of the most important factors in deciding whether graded whole life insurance is right for you is understanding the cost. Premiums vary significantly based on your age, gender, smoking status, and the coverage amount you choose.

Note: These rates are estimates based on industry averages as of 2025. Actual rates vary by insurance company and individual circumstances.

What Does This Mean in Real Terms?

Let’s put this in perspective. A 70-year-old non-smoking woman paying $95 per month for $10,000 in coverage would pay:

- Annual cost: $1,140

- Total paid over 10 years: $11,400

- Total paid over 15 years: $17,100

You can see that over time, you may pay more in premiums than the death benefit. This is why graded whole life insurance is best viewed as final expense coverage rather than an investment. Its real value is in providing peace of mind and protecting your family from unexpected costs.

Coverage Amount Options

Most graded whole life insurance policies offer coverage in these ranges:

- $5,000 – $10,000: Covers basic funeral and burial costs

- $15,000 – $20,000: Covers funeral plus some outstanding debts

- $25,000 – $35,000: Covers funeral, debts, and leaves a small inheritance

- Up to $50,000: Maximum coverage available from most carriers

Graded Whole Life vs. Other Options for Seniors

As a senior shopping for life insurance, you have several options. Let’s compare them so you can make an informed choice:

Graded Whole Life vs. Guaranteed Issue Whole Life

Guaranteed Issue Whole Life:

- Absolutely no health questions

- Higher premiums than graded whole life

- Longer graded benefit period (usually 2-3 years)

- Truly guaranteed acceptance for everyone within age limits

Graded Whole Life:

- Few basic health questions (3-5 questions)

- Lower premiums than guaranteed issue

- Shorter or same graded benefit period

- Near-guaranteed acceptance for those who pass health questions

Best For: If you can honestly answer “no” to the health questions, choose graded whole life for better rates. If you have very serious recent health issues, guaranteed issue might be your only option.

Graded Whole Life vs. Simplified Issue Whole Life

Simplified Issue Whole Life:

- More detailed health questions (10-15 questions)

- No medical exam required

- Better rates than graded or guaranteed issue

- Full death benefit from day one (no graded period)

- May decline applicants based on health answers

Best For: If you’re relatively healthy, try simplified issue first—you’ll get better rates and immediate full coverage.

Graded Whole Life vs. Pre-Need Funeral Insurance

Pre-Need Funeral Insurance:

- Pays directly to funeral home

- Covers only funeral expenses

- May be locked into one funeral home

- Often more expensive than graded whole life

Best For: Only if you’ve already selected a funeral home and want payments to go directly there.

Advantages and Disadvantages of Graded Whole Life Insurance

Let’s be honest about both the benefits and the drawbacks of graded whole life insurance.

Advantages

Accessible Coverage: If you have health issues, this may be your best or only option for life insurance coverage.

No Medical Exam Hassle: Skip the needles, blood tests, and doctor visits. Apply from your own home.

Predictable Costs: Your premium never increases, making it easy to budget.

Lifetime Coverage: The policy stays in force as long as you pay premiums—you can’t be cancelled due to age or health changes.

Immediate Accidental Death Coverage: If you die in an accident during the graded period, your family receives the full benefit.

Peace of Mind: Knowing your final expenses are covered removes a significant burden from your mind and your family.

Fast Approval: Most applications are approved within 24-48 hours, and coverage begins immediately.

Cash Value Growth: While minimal, the cash value component provides a small financial resource you can borrow against in emergencies.

Disadvantages

Graded Benefit Period: Your family won’t receive the full benefit if you die from natural causes in the first 2-3 years.

Higher Cost Per Dollar of Coverage: Premiums are expensive relative to the death benefit, especially as you age.

Limited Coverage Amounts: Maximum benefits are typically $25,000-$50,000, which may not be enough for all your needs.

May Pay More Than Benefit: If you live long enough, you could pay more in premiums than the death benefit amount.

Minimal Cash Value Growth: Don’t expect significant cash value accumulation like you’d get with traditional whole life insurance.

Age Restrictions: Most policies have upper age limits of 80-85 for new applicants.

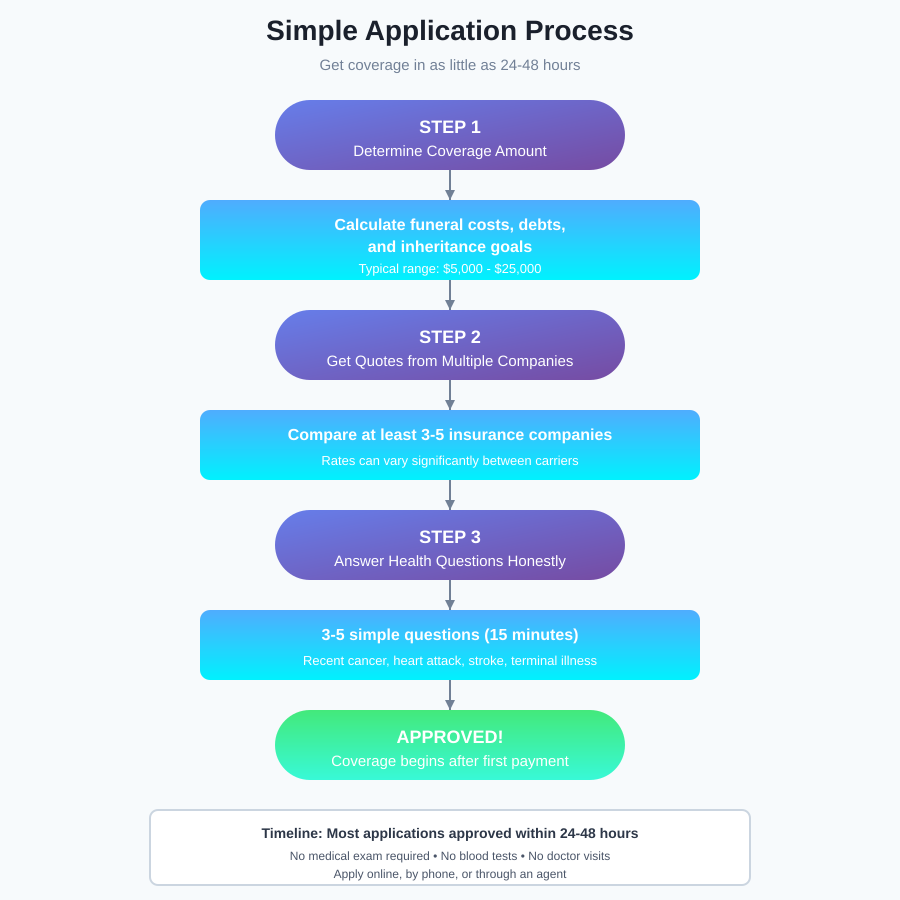

How to Apply for Graded Whole Life Insurance

The application process for graded whole life insurance is refreshingly simple, especially compared to traditional life insurance. Here’s what to expect:

Step 1: Determine Your Coverage Needs Calculate your final expenses: funeral costs ($7,000-$15,000), outstanding debts, medical bills, and any amount you want to leave your family. This gives you your target coverage amount.

Step 2: Compare Quotes from Multiple Companies Don’t accept the first quote you receive. Different insurance companies offer different rates for the same coverage. Request quotes from at least 3-5 companies. Many online comparison tools can help with this.

Step 3: Review the Health Questions Before applying, carefully review the health questions. They typically ask about:

- Recent diagnosis or treatment for cancer (within 1-2 years)

- Recent heart attack or stroke (within 1-2 years)

- Current diagnosis of terminal illness

- Use of oxygen or wheelchair/walker

- Organ transplant or dialysis

If you can honestly answer “no” to these questions, you’ll likely be approved.

Step 4: Complete the Application You can usually apply online, over the phone, or by mail. The application takes about 15-20 minutes and asks for:

- Basic personal information

- Beneficiary details

- Health questions

- Payment information

Step 5: Review Your Policy Documents Once approved (usually within 1-2 business days), carefully review all policy documents. Pay special attention to:

- Premium amount and payment schedule

- Death benefit amount

- Length of graded benefit period

- Exclusions and limitations

- Free look period (typically 30 days to cancel with full refund)

Step 6: Make Your First Payment Your coverage typically begins as soon as your first payment is processed.

Step 7: Keep Your Policy Active Mark your premium due dates on your calendar or set up automatic payments. A lapsed policy means your beneficiaries receive nothing.

Important Things to Consider Before Buying

Before you purchase graded whole life insurance, consider these important factors:

Alternative Options: Have you exhausted all other options? If you’re in reasonably good health, simplified issue life insurance might offer better value.

Budget Impact: Can you comfortably afford the premiums for the rest of your life? Remember, if you stop paying, you lose coverage and all premiums paid.

Actual Need: Do you really need life insurance? If you have sufficient savings to cover final expenses and no financial dependents, you might not need coverage at all.

Timing Matters: Because of the graded benefit period, this insurance is best purchased when you’re relatively stable health-wise and expect to live beyond the 2-3 year waiting period.

Inflation Impact: A $10,000 policy today might not cover as much in 10-15 years due to inflation. Consider inflation-adjusted coverage if available.

Family Communication: Make sure your beneficiaries know you have this policy and where to find the policy documents when needed.

Frequently Asked Questions (FAQ)

What exactly does “graded death benefit” mean?

A graded death benefit means your beneficiaries don’t receive the full death benefit if you die from natural causes during the first 2-3 years of the policy. Instead, they receive either a return of premiums paid plus interest, or a percentage of the full benefit (like 50% in year two). After the graded period ends, they receive the full benefit regardless of cause of death. However, death from an accident typically pays the full benefit immediately, even during the graded period.

How long is the graded benefit period?

A graded death benefit means your beneficiaries don’t receive the full death benefit if you die from natural causes during the first 2-3 years of the policy. Instead, they receive either a return of premiums paid plus interest, or a percentage of the full benefit (like 50% in year two). After the graded period ends, they receive the full benefit regardless of cause of death. However, death from an accident typically pays the full benefit immediately, even during the graded period.

How long is the graded benefit period?

Most graded whole life insurance policies have a graded benefit period of either two or three years. The length varies by insurance company and specific policy. Always confirm the graded period length before purchasing. After this period ends, your beneficiaries receive the full death benefit no matter how you die.

Can I be denied graded whole life insurance?

While graded whole life insurance is much easier to get than traditional life insurance, you can still be declined if you answer “yes” to certain health questions. For example, if you’ve had cancer treatment in the past 12-24 months, suffered a recent heart attack or stroke, or have a terminal illness, you might be denied. However, if you can answer “no” to all the health questions (typically 3-5 questions), you’ll almost certainly be approved.

What happens if I die in an accident during the graded period?

This is an important benefit: if you die from an accident at any time—even during the graded benefit period—your beneficiaries typically receive the full death benefit immediately. The graded benefit period only applies to death from natural causes or illness. Some policies may have specific definitions of what counts as an accident, so review your policy documents carefully.

Is graded whole life insurance worth it for someone my age?

It depends on your specific situation. Graded whole life insurance is worth it if you: (1) have health issues that prevent you from getting other coverage, (2) want to ensure your final expenses are covered, (3) want to leave something for your loved ones, and (4) can comfortably afford the premiums. However, if you’re in good health, have savings to cover final expenses, or the premiums would strain your budget, it might not be necessary. Consider your personal financial situation and goals.

How much does graded whole life insurance cost per month?

The monthly cost varies significantly based on your age, gender, smoking status, and coverage amount. As a general guide, a 70-year-old non-smoking woman might pay $80-$110 per month for $10,000 in coverage, while a 70-year-old non-smoking man might pay $105-$145 per month for the same coverage. Smokers pay considerably more—sometimes 60-80% higher premiums. The older you are when you apply, the higher your monthly premium will be.

Can I cancel my graded whole life insurance policy?

Yes, you can cancel your policy at any time. However, keep in mind that if you cancel, you lose all coverage and any cash value that has accumulated typically goes to the insurance company (though some policies allow you to receive a small surrender value after many years). Most policies include a “free look” period of 30 days after purchase during which you can cancel and receive a full refund of premiums paid. Think carefully before canceling, as you may not be able to get new coverage at your current age and health status.

No, your premiums are locked in at the rate you pay when you first purchase the policy. This is one of the benefits of graded whole life insurance—your monthly payment stays the same for your entire life, even as you age into your 80s, 90s, or beyond. This makes budgeting easier and protects you from future rate increases.

What’s the difference between graded whole life and guaranteed issue life insurance?

The main differences are: (1) Health questions—graded whole life asks a few basic health questions (usually 3-5), while guaranteed issue asks none at all. (2) Cost—graded whole life typically has lower premiums than guaranteed issue because of the health questions. (3) Acceptance—guaranteed issue accepts everyone within the age range, while graded whole life may decline applicants who answer “yes” to health questions. If you can honestly answer “no” to the health questions, graded whole life is usually the better choice because of the lower cost.

How do I make sure my family receives the death benefit?

To ensure your family receives the death benefit: (1) Keep your policy active by never missing a premium payment—set up automatic payments if possible. (2) Tell your beneficiaries you have the policy and where the policy documents are kept. (3) Review your beneficiary designations annually and update them if your family situation changes. (4) Keep your insurance company’s contact information with your policy documents. (5) Consider giving your agent’s contact information to your beneficiaries. When you pass away, your beneficiaries should contact the insurance company as soon as possible and provide a death certificate.

Can I borrow money from my graded whole life insurance policy?

Yes, most graded whole life insurance policies build a small amount of cash value over time that you can borrow against. However, the cash value grows very slowly in these policies—it may take 5-10 years before there’s enough to borrow. When you take a policy loan, you’re borrowing against your death benefit, and any unpaid loan amount plus interest will be deducted from the death benefit when you die. Policy loans typically have lower interest rates than credit cards or personal loans and don’t require credit checks or approval.

Conclusion

Graded whole life insurance serves an important purpose for seniors who want to protect their families from the financial burden of final expenses but can’t qualify for traditional life insurance due to health issues.

Yes, it has limitations—the graded benefit period means your family won’t receive the full death benefit if you pass away from natural causes in the first few years, and the premiums are higher relative to the coverage amount than other types of insurance. But for many seniors, it’s the only accessible option for life insurance coverage.

The key is understanding exactly what you’re buying and making sure it fits your specific situation. If you have chronic health conditions, have been declined by other insurers, and want to leave money to cover your final expenses or provide a small inheritance to your loved ones, graded whole life insurance can provide valuable peace of mind.

Before making a decision, take time to:

- Calculate your actual final expense needs

- Compare quotes from multiple insurance companies

- Consider whether other types of coverage might work for you

- Ensure the premiums fit comfortably in your long-term budget

- Discuss your decision with family members or a trusted financial advisor

Remember, the best insurance policy is one that you can afford to keep in force and that meets your family’s actual needs. Don’t let high-pressure sales tactics rush you into a decision. Take your time, ask questions, and choose wisely.

Your family will appreciate the thoughtfulness and care you put into planning for the future, even if it’s not a comfortable topic to think about. That’s what love looks like—taking care of the practical details so your loved ones can focus on memories, not money, when the time comes.