Guaranteed Issue Life Insurance

If you have found this page, then it’s likely that you have been declined for traditional life insurance and you are looking for coverage that doesn’t ask any health questions. Guaranteed issue life insurance may be the answer.

Guaranteed issue whole life insurance can provide your loved ones with some financial protection from end-of-life expenses such as burial costs.

Topics Covered in this Article

What is Guaranteed Issue Life Insurance?

Guaranteed issue life insurance offers coverage to individuals who cannot qualify for traditional life insurance. Sometimes referred to as guaranteed acceptance life insurance, these policies ask no health questions nor require an exam. Guaranteed acceptance life insurance is a whole life policy, therefore the coverage lasts as long as you pay the premium.

Since there are no health questions your premium is based on your age, gender, and location. Guaranteed issue whole life insurance is belongs in the final expense insurance category.

Guaranteed acceptance life insurance comes with death benefits ranging from $2K-$25K. Premiums are always guaranteed for life and these policies do build up cash value.

I know all this sounds great (no exam, no health questions, guaranteed issue) but there is a catch. With guaranteed issue life insurance, during the first 2 years of the policy, claims are only paid for accidental deaths. Natural deaths in the first 2 years are not covered. If natural death does occur in the first 2 years, your premium plus 10% will be returned to your beneficiaries.

Should I buy Guaranteed Acceptance Life Insurance?

While it’s the most convenient way, we don’t recommend guaranteed issue life insurance unless you are unable to qualify for traditional life insurance.

You should first consider the drawbacks of guaranteed acceptance life insurance like:

- Waiting period for natural death is 2 years in most cases

- Premiums are substantially higher than traditional life insurance

Guaranteed acceptance life insurance should be able to provide a large enough death benefit if you are looking to cover your end-of-life expenses. But if you are looking coverage to replace income or pay off a mortgage, guaranteed acceptance life insurance would not be the answer.

If you have any of the following health conditions then guaranteed issue whole life insurance is a good choice:

- You have a terminal illness with a life expectancy of less than two years.

- You have had or need an organ or a tissue transplant.

- You are on dialysis.

- You have Alzheimer’s or dementia.

- You are in a nursing home or in hospice.

- You have cancer (and it’s not basal cell or squamous cell skin cancer).

- You have AIDS or HIV.

- You are in a wheelchair because of a chronic illness or disease.

- You have had a heart attack in the last 2 years.

- You have congestive heart disease.

If you can answer no to these questions then you may be able to qualify for a simplified issue whole life policy.

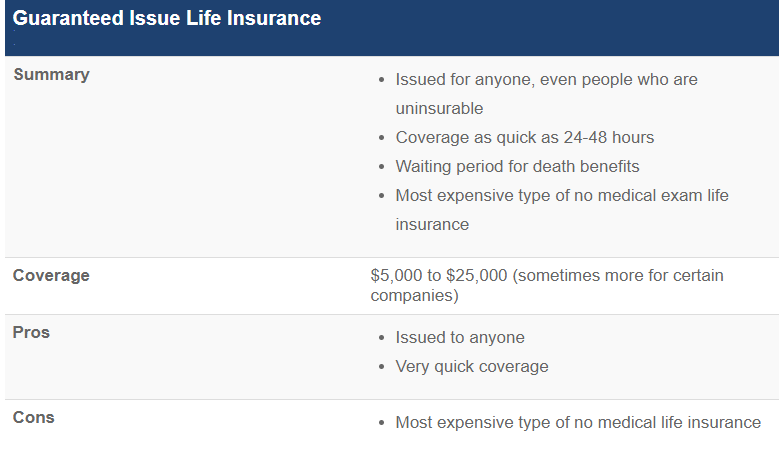

Guaranteed Issue Whole Life Insurance Summary

The Best Guaranteed Issue Life Insurance Companies + Rates

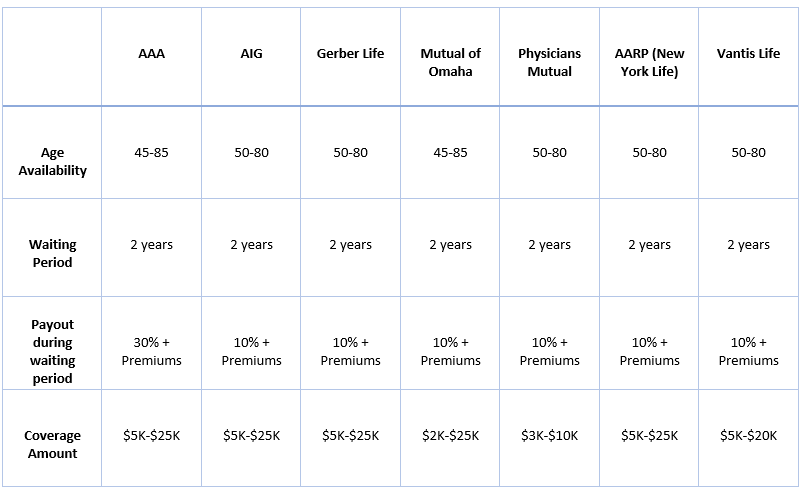

We have compiled a list of best guaranteed issue life insurance companies + rates. Remember that most guaranteed issue polices function the same, the major difference will be price.

AIG Guaranteed Issue Whole Life

AIG is a household name when it comes to insurance. AIG has more than 90 million policyholders in over 130 different countries.

AIG guaranteed issue whole life insurance offers coverage between $5K-$25K to consumers age 50-85 years old.

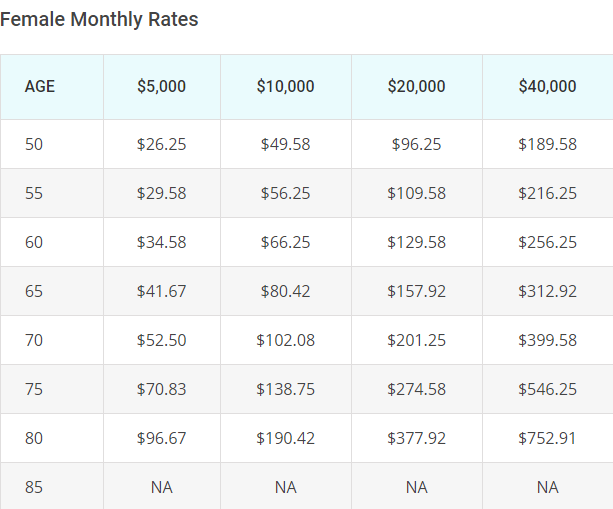

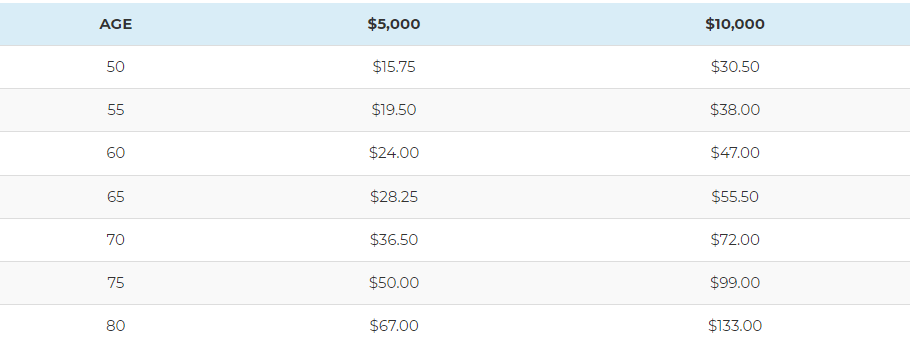

AIG guaranteed issue whole life Rates

AARP Guaranteed Acceptance Whole Life

AARP guaranteed acceptance whole life insurance is sold through New York Life Insurance company to its members and their spouses.

AARP offers a no medical guaranteed issue whole life insurance policy with very competitive rates. Issue ages for AARP guaranteed acceptance life insurance is 50-80 with face amounts ranging from $5K-$25K.

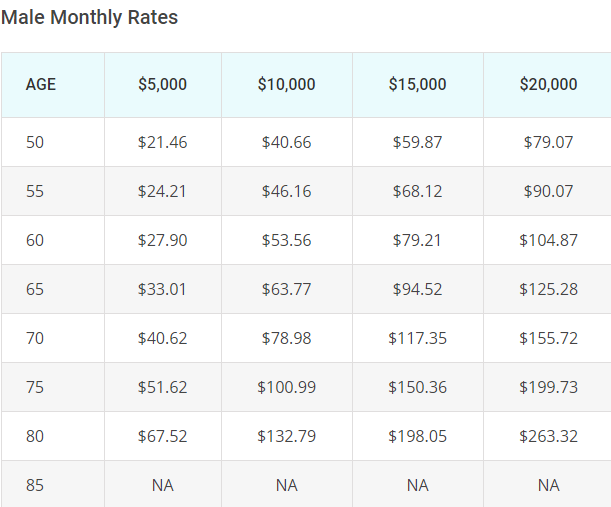

AARP guaranteed acceptance rates:

Gerber Life Insurance Company

Gerber Life Insurance company is best known for their Gerber Grow Up Plan for children, but they also offer a guaranteed issue whole life policy for adults.

Gerber has been doing business since 1927 and boasts an “A” rating with A.M. Best. They have over $45 billion of life insurance on the books with over 3.3 million policies.

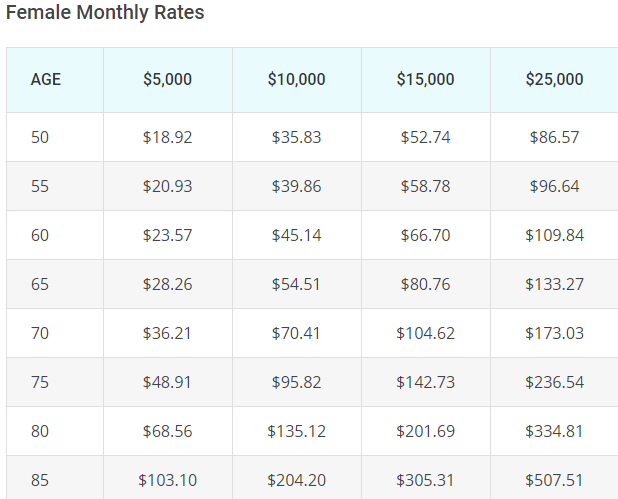

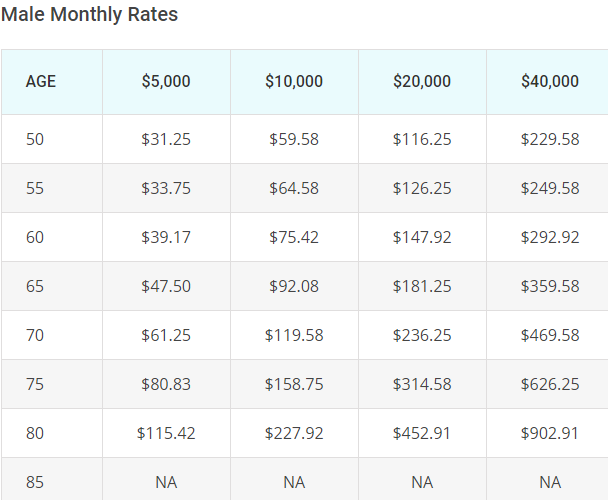

Gerber Life’s guaranteed issue whole life offers coverage to consumers between the age of 50-80 with death benefits ranging from $5K-$25K.

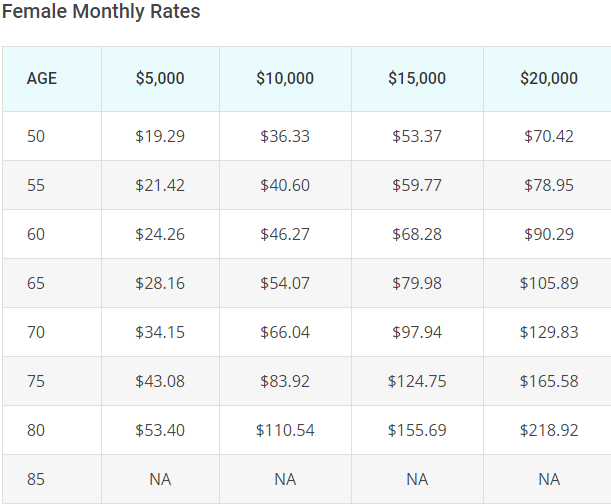

Gerber Life Guaranteed Issue Life Rates:

Vantis Life Guaranteed Issue Whole Life

This company is probably one you haven’t heard to often, however, they have been in business since 1942. Based out of Windsor, Connecticut, Vantis Life merged with The Penn Mutual Life Insurance Company in 2016. Penn Mutual carries an “A+” rating with A.M. Best while Vantis Life boasts an “A-“.

Vantis Life’s guaranteed issue whole life offers coverage to consumers age 50-80 with death benefit amounts ranging from $5K-$20K.

Vantis Life Guaranteed Issue Rates

Mutual of Omaha Guaranteed Issue Life

Mutual of Omaha has been selling insurance products since 1909. Mutual of Omaha offers guaranteed acceptance whole life insurance through there captive channel.

Mutual of Omaha guaranteed acceptance whole life is for seniors age 45-85 with death benefits ranging from $2K-$25K.

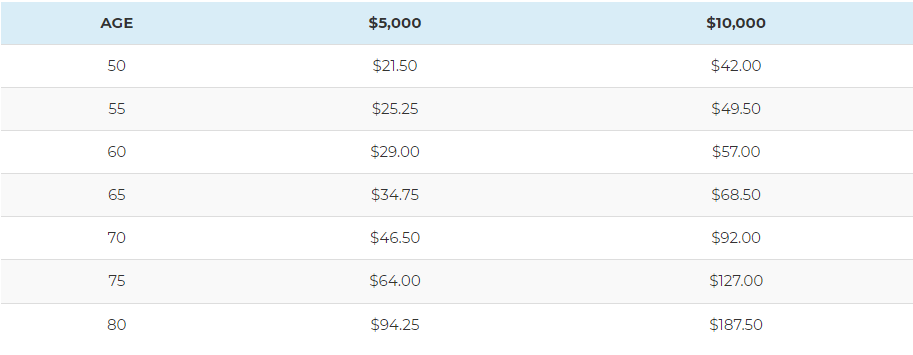

Mutual of Omaha Guaranteed Issue Rates

Male Monthly Rates

Female Monthly Rates

AAA Guaranteed Acceptance Life

AAA Life Insurance Company has been selling insurance since 1969. They boast an “A-” rating with A.M. Best.

AAA guaranteed acceptance life is available for consumers age 45-85 with death benefits ranging from $5K-$25K. AAA guaranteed acceptance life grants you 30% interest + premiums during the waiting period. This is much higher than the industry standard of 10% + premiums.

AAA Guaranteed Acceptance Rates

Male Rates

Female Rates

Physicians Mutual Guaranteed Acceptance

Physicians Mutual has been in business since 1902. They have an “A” rating with A.M. Best rating agency. Issue ages for Physician Mutual guaranteed acceptance whole life is 50-80 years old. Death benefits range from $3K-$10K.

Physicians Mutual Guaranteed Acceptance Rates

Male Rates

Female Rates

Summary

What to do before buying

If you have been turned down for traditional life insurance and feel that guaranteed acceptance whole life may be your only option, there are a few things you should do before buying.

The first thing you can do is consult with an independent life insurance agent, that represents at least 10 different insurance companies. They will be able to help you in choosing which type of policy you could qualify for.

Most life insurance companies design their underwriting to cover certain health risks. Having access to those companies is key to ensuring you get the best policy available for you. A captive agent only has access to the polices sold by one company, so working with an independent agent is crucial.

Make sure to have a detailed list of your health conditions for your agent. This will help them find the best company to use and hopefully get you the coverage you want. If you have any questions, or need a quote, let us know. Thanks for reading.