Life Insurance for Seniors with Diabetes: Your Complete Guide

Is life insurance for seniors with diabetes possible? The answer is absolutely yes. While diabetes does affect your options and premiums, thousands of seniors with diabetes secure affordable life insurance coverage every year. This comprehensive guide will show you exactly how to get approved, which companies offer the best rates, and what to expect during the application process.

Understanding Life Insurance Options for Diabetic Seniors

Getting life insurance with diabetes is more achievable than many people realize. Insurance companies have become significantly more accommodating to diabetic applicants, especially those who manage their condition well. The key is understanding which type of policy fits your health profile and choosing the right insurance company.

How Insurance Companies View Diabetes

Insurance underwriters assess diabetes cases individually, considering several critical factors:

Type of Diabetes:

- Type 1 diabetes (insulin-dependent) is viewed as higher risk

- Type 2 diabetes (non-insulin dependent) typically receives better rates

- Well-managed Type 2 diabetes may qualify for standard rates

Disease Management:

- HbA1c levels (target: below 7% is excellent, below 8% is good)

- Frequency of blood sugar monitoring

- Medication compliance and dosage

- Regular doctor visits and follow-up care

- Absence of complications

Complications Assessment:

- Diabetic retinopathy (eye damage)

- Neuropathy (nerve damage)

- Nephropathy (kidney disease)

- Cardiovascular issues

- Foot problems or amputations

- History of diabetic comas or hospitalizations

The better you manage your diabetes and the fewer complications you have, the more favorable your insurance rates will be.

Best Life Insurance for Seniors With Diabetes

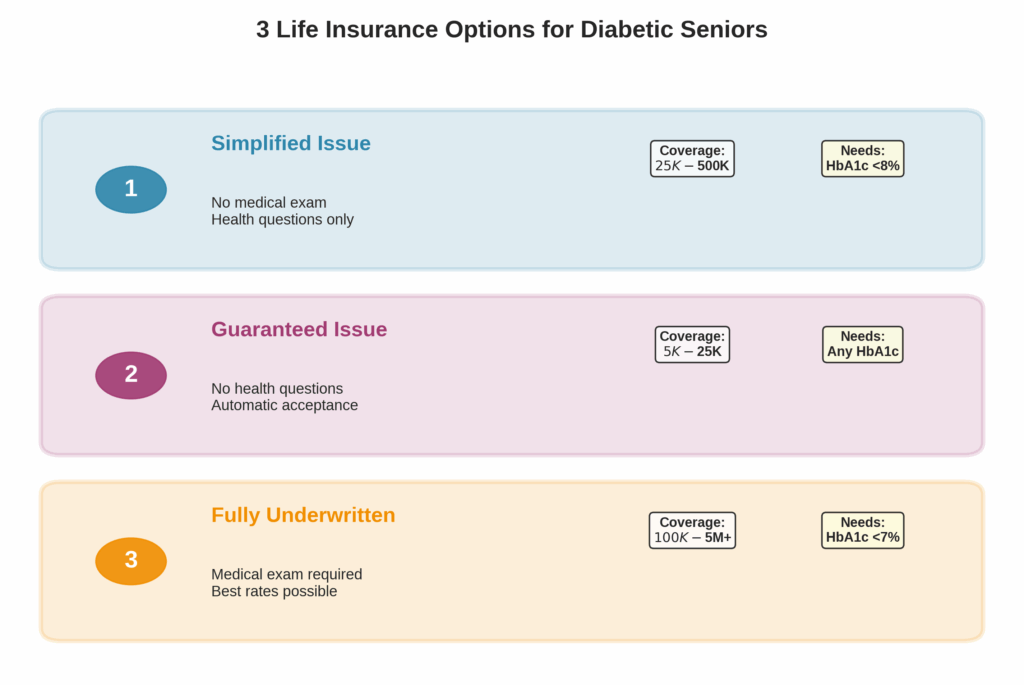

1. Simplified Issue Life Insurance

Simplified issue life insurance for seniors with diabetes requires no medical exam, just answers to health questions. This is often the sweet spot for seniors with well-managed diabetes.

Ideal For:

- Seniors with Type 2 diabetes under good control

- Those with HbA1c levels below 8%

- Diabetics without major complications

- People who want to avoid medical exams

Pros:

- No needles, blood tests, or physical exams

- Faster approval (24-48 hours typically)

- Coverage up to $500,000 available

- Immediate coverage in most cases

Cons:

- Slightly higher premiums than fully underwritten policies

- Must honestly answer health questions

- May be declined if complications exist

- Limited to certain age ranges (typically up to 75-80)

Top Companies Offering Simplified Issue:

- Mutual of Omaha

- AIG (American General)

- Protective Life

- Prudential

- John Hancock

2. Guaranteed Issue Life Insurance

Guaranteed issue life insurance for seniors with diabetes accepts all applicants regardless of health conditions, making them ideal for seniors with poorly controlled diabetes or significant complications.

Ideal For:

- Seniors with Type 1 diabetes

- Those with diabetes complications

- Diabetics with multiple health conditions

- Anyone who’s been declined elsewhere

Pros:

- Absolutely no health questions asked

- Cannot be denied coverage

- No medical exam or records required

- Quick approval process

Cons:

- Lower coverage limits (typically $5,000-$25,000)

- Higher premiums per dollar of coverage

- Waiting period of 2-3 years for natural death

- Best suited for final expense coverage

Top Companies Offering Guaranteed Issue:

- Mutual of Omaha

- Gerber Life

- Colonial Penn

- Globe Life

- Transamerica

3. Fully Underwritten Life Insurance for Seniors with Diabetes

If your diabetes is exceptionally well-controlled, you might qualify for traditional life insurance with competitive rates.

Ideal For:

- Seniors with Type 2 diabetes diagnosed recently

- Those with HbA1c consistently below 7%

- Diabetics with no complications whatsoever

- People who maintain excellent overall health

Pros:

- Best possible rates if approved

- Highest coverage amounts available

- More policy options and riders

- Potential for preferred or standard ratings

Cons:

- Requires full medical exam

- Longer approval process (2-6 weeks)

- May be declined if diabetes isn’t well-controlled

- Most invasive application process

Top Companies for Well-Controlled Diabetics:

- Banner Life

- Pacific Life

- Principal Financial

- Lincoln Financial

- Nationwide

Comparison Table: Life Insurance Options for Diabetic Seniors

| Policy Type | Coverage Amount | Medical Exam | Waiting Period | Best For | Approval Time | Typical Premium* |

|---|---|---|---|---|---|---|

| Simplified Issue | $25K-$500K | No | None | Well-managed diabetes | 24-48 hours | $150-$300/month |

| Guaranteed Issue | $5K-$25K | No | 2-3 years | Complications present | Instant-3 days | $75-$150/month |

| Fully Underwritten | $100K-$5M+ | Yes | None | Excellent control | 2-6 weeks | $100-$250/month |

| Group Life (Employer) | $10K-$100K | No | None | Still employed | Immediate | Varies/Often free |

| Final Expense | $5K-$35K | No | 0-2 years | Burial costs only | 1-5 days | $60-$120/month |

*Premium examples for $100,000 coverage for a 65-year-old with controlled Type 2 diabetes

Real-Life Examples: Seniors With Diabetes Getting Coverage

Example 1: Martha, Age 68, Type 2 Diabetes

Health Profile:

- Diagnosed with Type 2 diabetes 8 years ago

- Takes metformin (oral medication)

- HbA1c: 6.8% (excellent control)

- No complications

- Regular exercise and healthy diet

- Non-smoker

What She Did: Martha applied for simplified issue life insurance through Mutual of Omaha. She answered 10 health questions honestly, disclosing her diabetes but highlighting her excellent management.

Result: Approved within 36 hours for $150,000 coverage at $187/month. No medical exam required. Coverage started immediately.

Key Takeaway: Well-controlled Type 2 diabetes with good HbA1c levels can qualify for simplified issue policies with reasonable rates.

Example 2: Robert, Age 73, Type 2 Diabetes With Complications

Health Profile:

- Type 2 diabetes for 15 years

- Takes insulin injections

- HbA1c: 8.4% (fair control)

- Mild diabetic neuropathy in feet

- Previous heart attack 5 years ago

- Overweight but stable

What He Did: Robert was declined by two simplified issue companies. He then applied for guaranteed issue coverage through Gerber Life, which asks no health questions.

Result: Automatically approved for $15,000 coverage at $98/month. Two-year waiting period applies (if he dies of natural causes in years 1-2, beneficiaries receive premiums paid plus 10% interest). After two years, full benefit paid.

Key Takeaway: Seniors with complications can still get coverage through guaranteed issue policies, though coverage amounts are lower and waiting periods apply.

Example 3: David, Age 62, Recently Diagnosed Type 2

Health Profile:

- Diagnosed 18 months ago

- Diet-controlled (no medication yet)

- HbA1c: 6.5% (excellent)

- Lost 30 pounds since diagnosis

- Regular exercise program

- Excellent overall health otherwise

What He Did: David worked with an independent insurance agent who suggested trying for fully underwritten coverage given his excellent control and recent diagnosis. He completed a medical exam including blood work.

Result: Approved by Banner Life for $500,000 in 20-year term life insurance at $245/month (standard non-tobacco rates). His excellent management earned him the same rates as someone without diabetes in his age group.

Key Takeaway: Recently diagnosed diabetics with exceptional management may qualify for standard rates with fully underwritten policies.

Example 4: Patricia, Age 77, Type 1 Diabetes

Health Profile:

- Type 1 diabetes since childhood

- Takes insulin (pump)

- HbA1c: 7.2% (good control for Type 1)

- Some retinopathy (managed)

- Otherwise healthy and active

- Never had diabetic coma or severe hypoglycemia

What She Did: Patricia knew Type 1 diabetes would make approval challenging. She applied for guaranteed issue coverage, knowing she’d be accepted regardless of her condition.

Result: Approved through Colonial Penn for $10,000 coverage at $67/month. Two-year waiting period applies. Her goal was covering funeral expenses, which this policy accomplishes.

Key Takeaway: Type 1 diabetics often need guaranteed issue policies, but coverage is available specifically for final expenses.

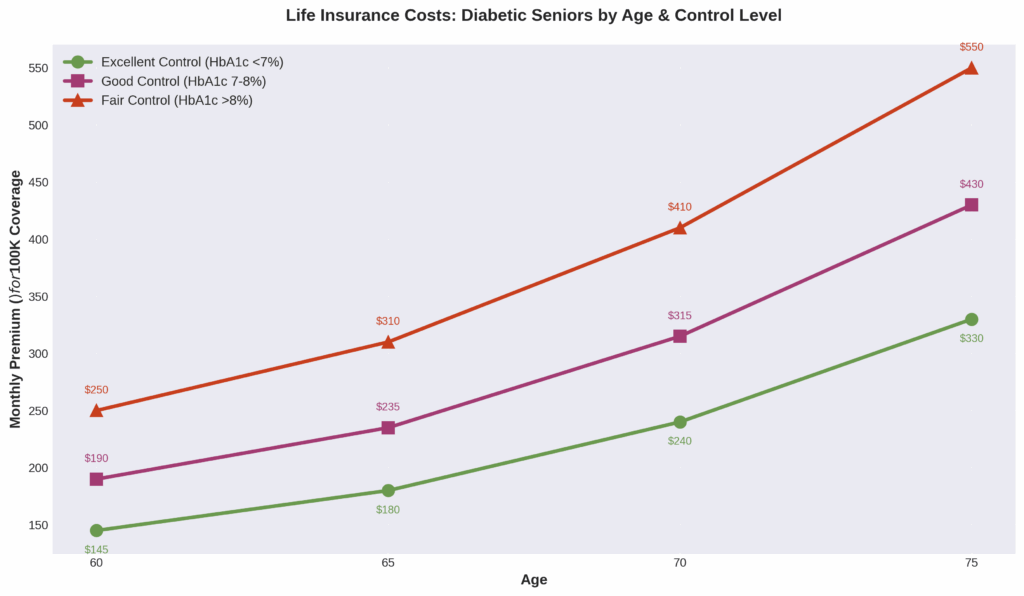

Cost Breakdown: What Diabetic Seniors Pay

The premium for life insurance for seniors with diabetes varies widely based on type, control level, age, and policy type. Here’s what you can expect:

Monthly Premium Estimates by Age and Diabetes Control

For $100,000 Coverage (Simplified Issue):

| Age | Excellent Control (HbA1c <7%) | Good Control (HbA1c 7-8%) | Fair Control (HbA1c >8%) |

|---|---|---|---|

| 60 | $125-$165 | $165-$215 | $215-$285 |

| 65 | $155-$205 | $205-$265 | $265-$345 |

| 70 | $205-$275 | $275-$355 | $355-$465 |

| 75 | $285-$375 | $375-$485 | Often declined |

For $10,000 Coverage (Guaranteed Issue):

| Age | Monthly Premium |

|---|---|

| 60 | $45-$65 |

| 65 | $55-$80 |

| 70 | $70-$100 |

| 75 | $90-$130 |

| 80 | $115-$165 |

Factors That Affect Your Premiums

Premium Reducers:

- HbA1c below 7%

- Type 2 vs Type 1 diabetes

- Diet-controlled or oral medication only

- No diabetes complications

- Regular doctor visits and monitoring

- Healthy BMI

- Non-smoker status

- Female gender (typically 20-30% less)

Premium Increasers:

- Insulin dependency

- HbA1c above 8%

- Existing complications

- Multiple health conditions

- Smoker status

- Poorly documented medical records

- History of non-compliance

- Male gender

How to Get Approved: Step-by-Step Strategy

Step 1: Optimize Your HbA1c Before Applying

Your HbA1c (average blood sugar over 3 months) is the single most important factor. If possible:

- Work with your doctor to get HbA1c below 7% (excellent) or at least below 8% (good)

- Wait 3-6 months after diagnosis to establish management pattern

- Document consistent monitoring and medication compliance

- Get current HbA1c test within 30 days of application

Step 2: Gather Your Medical Documentation

Collect these documents before applying:

- Last 3 HbA1c test results

- Current medication list with dosages

- Recent doctor’s notes showing good management

- List of any complications and how they’re managed

- Blood pressure and cholesterol levels

- Eye exam results if applicable

- Kidney function tests if applicable

Step 3: Choose the Right Policy Type

Choose Simplified Issue If:

- HbA1c is below 8%

- You have no or minimal complications

- You want coverage over $25,000

- You need immediate full coverage

Choose Guaranteed Issue If:

- You have diabetes complications

- HbA1c is above 8.5%

- You’ve been declined elsewhere

- You only need final expense coverage

Choose Fully Underwritten If:

- HbA1c is below 7% consistently

- You have zero complications

- You want the absolute best rates

- You’re willing to do medical exam

Step 4: Work With the Right Agent or Company

Independent Insurance Agents:

- Can shop multiple companies for you

- Know which insurers are most diabetic-friendly

- Understand underwriting guidelines

- Can position your application favorably

- Cost you nothing (paid by insurance company)

Direct-to-Company:

- Good if you know exactly which company to use

- Faster for guaranteed issue policies

- Online applications available 24/7

- No agent relationship to maintain

Step 5: Be Completely Honest on Your Application

Insurance companies will verify your medical information during the underwriting process and have access to:

- Medical Information Bureau (MIB) database

- Prescription drug databases

- Your medical records (with your authorization)

- DMV records

- Public records

Lying or omitting information will result in:

- Application denial

- Policy cancellation if discovered later

- Claim denial for beneficiaries

- Possible fraud charges

Always disclose:

- Diabetes diagnosis date and type

- All medications and dosages

- HbA1c levels

- Any complications or hospitalizations

- Other health conditions

- Lifestyle factors (smoking, drinking)

Step 6: Follow Up and Provide Additional Information

Be responsive if the insurance company requests:

- Additional medical records

- Physician statements

- Updated test results

- Clarification on health questions

Quick responses can speed approval and show you’re serious about coverage.

Companies Most Friendly to Diabetic Seniors

Mutual of Omaha

Rating: Excellent for Diabetics

- Offers both simplified and guaranteed issue

- Accepts Type 1 and Type 2 diabetes

- No upper HbA1c limit for guaranteed issue

- Competitive rates for well-managed diabetes

- Ages 45-85 accepted

AIG (American General)

Rating: Very Good for Type 2

- Simplified issue with instant decisions

- Accepts Type 2 diabetes with HbA1c up to 9%

- No medical exam required

- Coverage up to $500,000

- Ages 18-70 only

Prudential

Rating: Best for Well-Controlled Diabetes

- Simplified issue available

- Can qualify for standard rates with HbA1c below 7%

- Higher coverage limits

- Strong financial ratings

- Good for younger seniors (under 70)

Gerber Life

Rating: Best for Complications

- Guaranteed issue with no health questions

- Perfect for diabetics with complications

- Specifically designed for final expenses

- Ages 50-80

- No one is turned down

Banner Life

Rating: Best Rates for Excellent Control

- Fully underwritten policies

- Can get preferred rates with perfect control

- Highest coverage amounts

- Requires medical exam

- Worth it if HbA1c consistently below 6.5%

Special Considerations for Diabetic Seniors

Pre-Existing Condition Riders

Some policies exclude diabetes-related deaths for the first 1-2 years. Read your policy carefully to understand:

- What conditions are excluded

- Length of exclusion period

- Whether complications are covered

- Accidental death coverage

Conversion Rights

If you get term life insurance, ensure it includes:

- Conversion to permanent coverage option

- No medical questions for conversion

- Guaranteed conversion period

- Maximum conversion age

This protects you if your diabetes worsens over time.

Living Benefits and Riders

Look for policies offering:

- Accelerated death benefit: Access funds if terminally ill

- Chronic illness rider: Payment if unable to perform daily activities

- Waiver of premium: Coverage continues if disabled

- Accidental death benefit: Double payout for accidental death

These can be especially valuable for diabetics who may face complications.

Group Life Insurance Through Employers

If you’re still working or recently retired, check for:

- Group life insurance through employer

- Retiree life insurance programs

- Professional association group policies

- AARP or senior organization policies

Group policies typically:

- Don’t require medical underwriting

- Accept pre-existing conditions

- Offer guaranteed issue amounts

- Cost less than individual policies

However, coverage usually ends when you leave the employer or organization.

Frequently Asked Questions

Can seniors with Type 1 diabetes get life insurance?

Yes, seniors with Type 1 diabetes can get life insurance, though options are more limited than for Type 2. Guaranteed issue policies are usually the best choice for Type 1 diabetics, as they require no health questions and cannot decline applicants. Coverage typically ranges from $5,000-$25,000, which is sufficient for final expenses. If your Type 1 diabetes is exceptionally well-managed with an HbA1c below 7% and no complications, some simplified issue insurers may also consider your application.

What HbA1c level do I need to qualify for life insurance?

For simplified issue policies, most insurers prefer HbA1c levels below 8%, with the best rates going to applicants below 7%. An HbA1c between 7-8% typically results in higher premiums but still qualifies you for coverage. Above 8.5-9%, most simplified issue companies will decline your application. However, guaranteed issue policies have no HbA1c requirements whatsoever—you’re accepted regardless of your blood sugar control. For fully underwritten policies with the best rates, aim for HbA1c consistently below 6.5-7%.

Does insulin use disqualify me from life insurance?

No, insulin use does not automatically disqualify you from life insurance. However, it does affect your options and premiums. Insulin-dependent diabetics typically pay higher premiums than those controlled by diet or oral medications. Many simplified issue policies accept insulin users if HbA1c is below 8% and there are no major complications. If you’ve had issues with insulin management or diabetic comas, guaranteed issue policies are your best option as they don’t ask about medications or complications.

How much does life insurance cost for a 70-year-old with diabetes?

A 70-year-old with well-controlled Type 2 diabetes (HbA1c below 7.5%) can expect to pay approximately $200-$300 per month for $100,000 in simplified issue coverage. For guaranteed issue coverage of $10,000-$15,000, premiums typically range from $70-$100 per month. Costs vary based on gender (women pay less), smoking status, specific HbA1c level, presence of complications, and the insurance company. Getting quotes from multiple insurers is essential as rates can vary by 30-40% between companies for the same coverage.

Can I get life insurance if I’ve had diabetic complications?

Yes, you can still get life insurance even with diabetic complications like neuropathy, retinopathy, or cardiovascular issues. Your best option is guaranteed issue life insurance, which accepts all applicants regardless of health status or complications. These policies typically offer $5,000-$25,000 in coverage with a 2-3 year waiting period. During the waiting period, if you die from natural causes, beneficiaries receive all premiums paid plus interest. After the waiting period, they receive the full death benefit. Simplified issue policies may decline applicants with complications.

What happens if my diabetes worsens after I get coverage?

Once you’re approved for life insurance, your premiums are locked in and cannot be increased due to worsening health, including diabetes complications. This is true for both term and whole life policies with level premiums. The insurance company cannot cancel your policy or raise rates as long as you pay your premiums on time. This is why getting coverage sooner rather than later is advantageous—lock in rates while you’re healthier. If you have a term policy, ensure it has a conversion option so you can convert to permanent coverage without medical questions if needed.

Should I disclose my diabetes even if the application doesn’t specifically ask?

Absolutely yes. You must disclose diabetes on any life insurance application, even if there’s no specific question about it. Applications typically ask about any medical conditions, medications, or doctor visits, which would include diabetes. Failing to disclose diabetes is considered fraud and can result in claim denial when your beneficiaries need the money most. Insurance companies verify medical information through prescription records, medical records, and databases. Being honest about your diabetes and management may result in higher premiums, but it ensures valid coverage.

For existing policies, no—premiums are locked in and won’t decrease even if your health improves. However, if you significantly improve your diabetes control, you can apply for a new policy with better rates and then cancel your old policy. For example, if you initially got guaranteed issue coverage but later achieve excellent diabetes control with HbA1c below 7%, you could apply for simplified or fully underwritten coverage at lower rates. Some term policies also allow “re-rating” after a certain period if your health improves substantially.

Is term or whole life insurance better for diabetic seniors?

This depends on your needs and budget. Term life insurance costs less and provides coverage for a specific period (10-30 years), making it ideal if you need temporary coverage for specific obligations like a mortgage. Whole life insurance costs more but provides lifetime coverage and builds cash value, making it better for permanent needs like final expenses or leaving an inheritance. For diabetic seniors, whole life is often preferred because it guarantees coverage regardless of how your health changes, whereas term coverage ends and may not be renewable if your diabetes worsens.

Can I get life insurance if I was just diagnosed with diabetes?

Yes, but it’s often better to wait 3-6 months after diagnosis to establish a management pattern. Insurance companies want to see that you’re controlling your diabetes effectively through medication compliance, blood sugar monitoring, and lifestyle changes. If you apply immediately after diagnosis without any HbA1c history, you’ll likely face higher premiums or possible decline. However, if you need immediate coverage, guaranteed issue policies accept you regardless of when you were diagnosed. For better rates, work with your doctor to achieve good control and then apply with that documented history.

Are there life insurance companies that specialize in diabetic applicants?

While no major insurers specialize exclusively in diabetics, several are notably more lenient and offer better rates for diabetic applicants. Mutual of Omaha, Prudential, AIG, and John Hancock are known for being diabetic-friendly with simplified issue options. For guaranteed issue (accepting anyone regardless of health), Gerber Life, Colonial Penn, and Mutual of Omaha have strong reputations. Working with an independent insurance agent who specializes in high-risk or diabetic cases is often the best strategy, as they know which companies are most likely to approve your specific situation.

No, life insurance premiums are not tax-deductible for individual policies, whether you have diabetes or not. However, the death benefit your beneficiaries receive is generally tax-free. If you’re self-employed and purchase life insurance as a business expense, or if you have certain types of business-owned life insurance, there may be some tax advantages, but personal life insurance premiums are paid with after-tax dollars. The silver lining is that your beneficiaries won’t pay income tax on the proceeds they receive.

Taking Action: Your Next Steps

Getting life insurance as a senior with diabetes is completely achievable. Here’s your action plan:

This Week:

- Check your most recent HbA1c result (or schedule a test if it’s been over 3 months)

- Gather your medical records related to diabetes

- Make a list of all current medications and dosages

- Decide how much coverage you need and for what purpose

This Month:

- Get quotes from at least 3-5 insurance companies

- Compare simplified issue vs guaranteed issue options

- Consider working with an independent insurance agent

- Ensure your diabetes is as well-controlled as possible

Before Applying:

- Review your budget to determine affordable premium

- Choose your beneficiaries

- Understand the waiting period if applying for guaranteed issue

- Prepare to be completely honest on your application

Remember: Every day you wait, you’re potentially getting older and possibly experiencing changes in health. The best time to apply for life insurance is when you’re healthiest and youngest. Even if you have diabetes, coverage is available—you just need to know where to look and how to apply.

Conclusion

Living with diabetes doesn’t mean you can’t secure life insurance protection for your loved ones. Whether you have well-controlled Type 2 diabetes that qualifies for simplified issue coverage or Type 1 diabetes with complications requiring guaranteed issue policies, options exist for every situation.

The key is understanding your health status, choosing the right type of policy, and working with diabetic-friendly insurance companies. With the strategies outlined in this guide, you can navigate the application process confidently and secure the coverage your family deserves.

Don’t let diabetes prevent you from protecting your family’s financial future. Start comparing quotes today and take the first step toward peace of mind.

Disclaimer: This article provides general information about life insurance for diabetic seniors and should not be considered medical, financial, or legal advice. Insurance availability, rates, and underwriting standards vary by company, state, and individual circumstances. Always consult with licensed insurance professionals and your healthcare provider when making insurance decisions. Premium examples and approval likelihood are estimates based on typical scenarios and may not reflect your specific situation.