Life Insurance for Seniors With Heart Disease: Yes, You CAN Get Covered

If you’ve been told you have heart disease—or you’ve already experienced a heart attack, had stents placed, or been diagnosed with congestive heart failure—you might be wondering if life insurance is even possible. I’m here with good news: yes, you absolutely can get life insurance for seniors with heart disease.

While your heart condition will affect your options and what you’ll pay, thousands of seniors with various heart conditions secure coverage every single year. The key is knowing which insurers are most accommodating, what type of policy fits your situation, and how to position your application for the best chance of approval.

In this guide, I’ll walk you through everything you need to know about getting life insurance for seniors with heart disease, including real examples from people in situations similar to yours.

Understanding How Life Insurance for Seniors with Heart Disease is Viewed by Underwriters

Let’s be honest: insurance companies are cautious about heart conditions, and for good reason—heart disease is the leading cause of death in the United States. But that doesn’t mean you’re automatically disqualified. What matters most is the specifics of your condition and how well you’re managing it.

What Insurance Underwriters Look At

When evaluating your application, insurance companies want to understand:

Type and Severity of Heart Condition:

- History of heart attacks (and how many)

- Coronary artery disease (CAD)

- Congestive heart failure (CHF) and ejection fraction

- Arrhythmias (atrial fibrillation, etc.)

- Valve problems or replacements

- Heart bypass surgery or angioplasty

- Stent placements

How Recently It Occurred:

- Heart events in the past 6-12 months are viewed most critically

- 2-5 years ago is better

- 5+ years ago with no complications is best

Your Current Management:

- Medications you’re taking (and compliance)

- Ejection fraction percentage (if CHF)

- Most recent stress test or cardiac imaging results

- Regular cardiologist visits

- Lifestyle changes (diet, exercise, smoking cessation)

Other Risk Factors:

- Smoking status (this is HUGE)

- Diabetes or high blood pressure

- High cholesterol levels

- BMI and weight management

- Family history

Here’s the reality: a 70-year-old who had a mild heart attack 5 years ago, quit smoking, takes their medications religiously, and has no complications will have completely different options than someone with recent congestive heart failure who’s still smoking.

The good news? There are options for both scenarios.

Your Life Insurance Options With Heart Disease

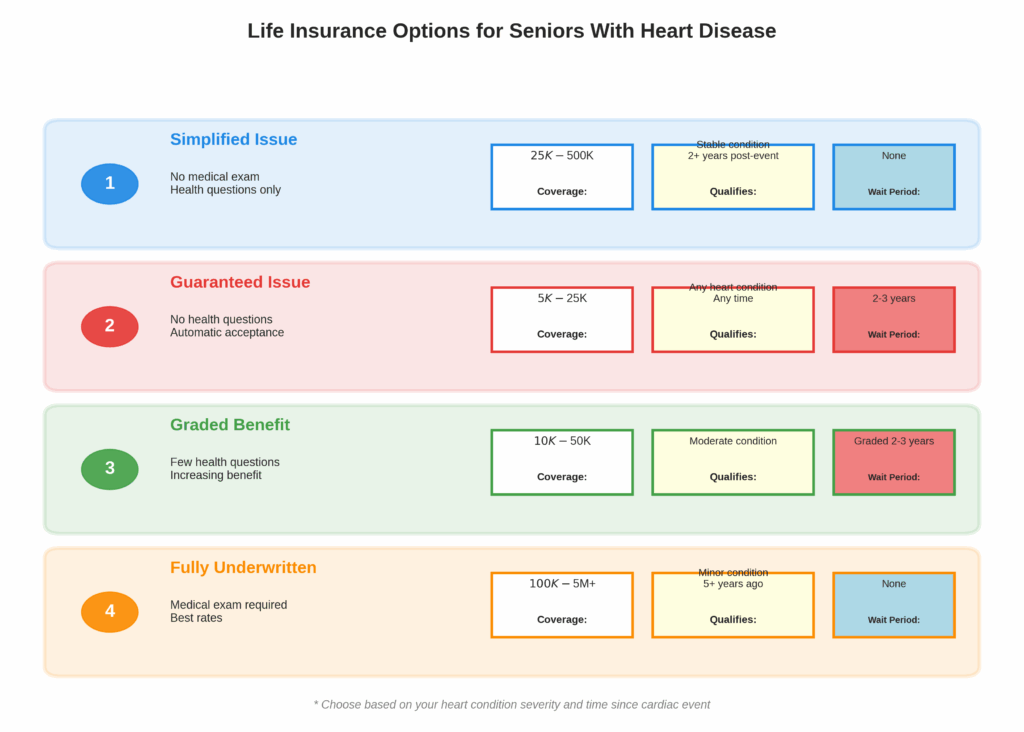

Option 1: Simplified Issue Life Insurance

This is often the sweet spot for seniors with stable, well-managed heart conditions.

How It Works:

- Answer 10-15 health questions (no medical exam)

- Application processed within 24-48 hours

- Coverage amounts typically $25,000-$500,000

- No waiting period—coverage starts immediately

Best For:

- Heart attack more than 2 years ago

- Successful stent or bypass with full recovery

- Stable angina well-controlled with medication

- Mild heart conditions with no recent symptoms

What You’ll Need to Disclose:

- Date and type of heart event

- Current medications

- Whether you’ve been hospitalized recently

- Smoking status

- Other health conditions

Pros: ✓ Much easier approval than traditional policies ✓ No needles, blood tests, or doctor visits required ✓ Quick decision—often approved same day ✓ Higher coverage amounts than guaranteed issue ✓ Immediate full coverage (no waiting period)

Cons: ✗ Not everyone qualifies (health questions can disqualify you) ✗ Premiums higher than traditional fully underwritten policies ✗ May be declined if heart disease is severe or recent ✗ Coverage limits lower than traditional insurance

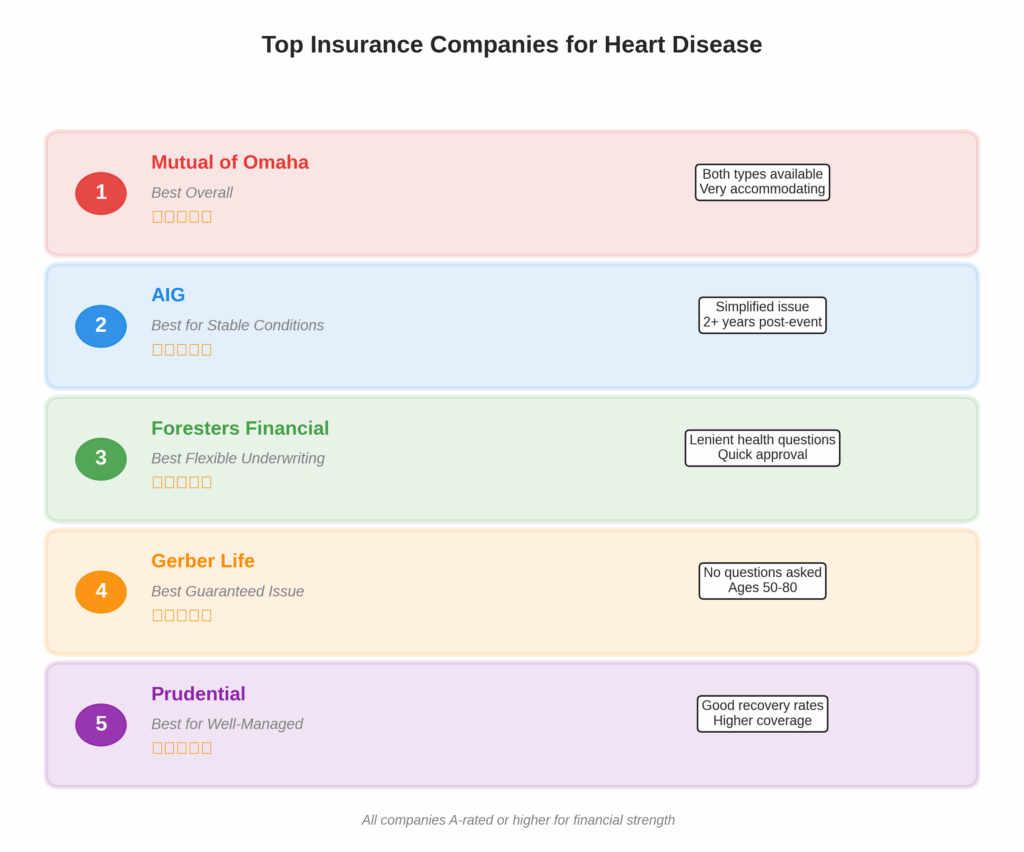

Top Companies for Simplified Issue:

- Mutual of Omaha (very accommodating to heart conditions)

- AIG (accepts stable heart disease)

- Prudential (good for well-managed cases)

- Foresters Financial (lenient underwriting)

Option 2: Guaranteed Issue Life Insurance

This is your safety net—no one can turn you down, regardless of your heart condition.

How It Works:

- Zero health questions asked

- Automatic acceptance regardless of conditions

- Coverage typically $5,000-$25,000

- Usually has a 2-3 year waiting period

Best For:

- Recent heart attack (within past 6-12 months)

- Congestive heart failure with low ejection fraction

- Multiple heart conditions or complications

- Anyone who’s been declined elsewhere

The Waiting Period Explained: During the first 2-3 years:

- If you die from an accident: Full benefit paid immediately

- If you die from illness/natural causes: Beneficiaries get all premiums paid back plus 10% interest

After the waiting period:

- Full death benefit paid for any cause of death

Pros: ✓ Absolutely cannot be denied ✓ No medical questions whatsoever ✓ Perfect for covering final expenses ✓ Simple application (5-10 minutes) ✓ Accidental death covered from day one

Cons: ✗ Lower coverage amounts ✗ Higher premiums per $1,000 of coverage ✗ Waiting period limits immediate benefit ✗ Not ideal if you need large coverage amounts

Top Companies for Guaranteed Issue:

- Mutual of Omaha (up to $25,000)

- Gerber Life (specifically designed for seniors)

- Colonial Penn (well-known for guaranteed acceptance)

- Globe Life (no health questions, fast approval)

Option 3: Graded Benefit Policies

This is a middle-ground option that combines elements of both simplified and guaranteed issue.

How It Works:

- Few or no health questions

- Acceptance is easier than simplified issue

- Death benefit increases over time (graded)

- Typically full benefit after 2-3 years

Example of Graded Benefits:

- Year 1: 30% of face value

- Year 2: 60% of face value

- Year 3+: 100% of face value

- Accidental death: 100% from day one

Best For:

- Moderate heart disease

- Recent procedures but good recovery

- Multiple health issues beyond heart disease

Option 4: Traditional Fully Underwritten (If Eligible)

If your heart condition was minor and it’s been many years, you might still qualify for traditional coverage.

Requirements:

- Heart event at least 5+ years ago

- No complications or symptoms since

- Excellent overall health otherwise

- Willing to undergo medical exam

Pros: ✓ Best possible rates ✓ Highest coverage amounts ✓ More policy options and riders

Cons: ✗ Requires full medical exam ✗ Lengthy approval process (4-8 weeks) ✗ Easy to be declined ✗ Most invasive application

Real-Life Stories: Seniors With Heart Disease Getting Coverage

Let me share some real examples to show you what’s actually possible.

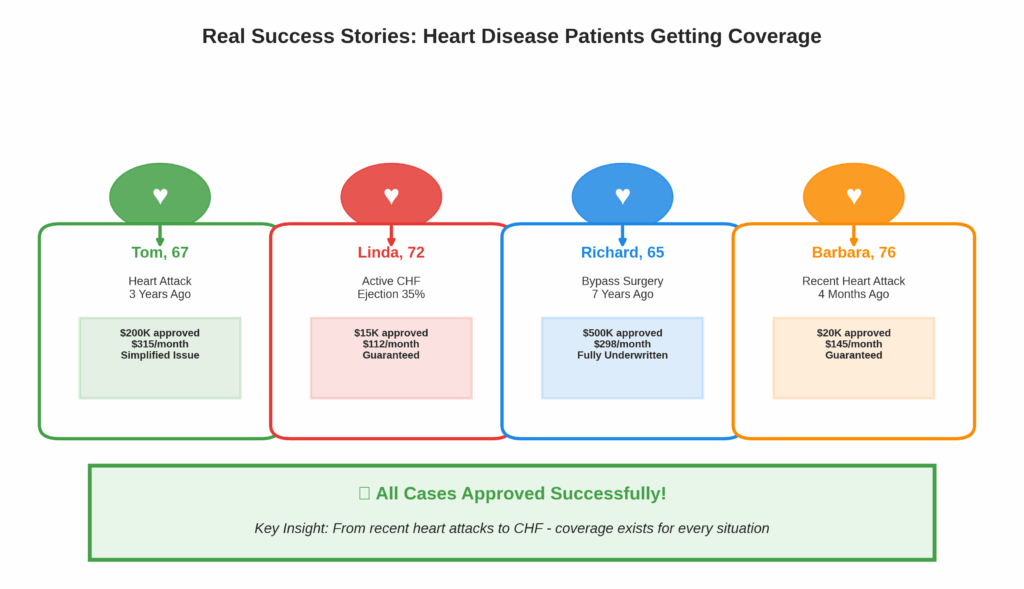

Case Study 1: Tom, Age 67 – Heart Attack 3 Years Ago

Heart Condition:

- Myocardial infarction (heart attack) 3 years ago

- Had 2 stents placed

- Takes blood thinners, beta blockers, and statins

- Quit smoking after heart attack

- Regular cardiologist visits

- No symptoms or complications since

What He Did: Tom applied for simplified issue life insurance through AIG. He answered health questions honestly about his heart attack and stent placement. He emphasized his excellent recovery, medication compliance, and smoking cessation.

Result: Approved for $200,000 in coverage at $315/month within 48 hours. No medical exam required. Coverage started immediately.

Key Takeaway: A heart attack 3+ years ago with good recovery and management can qualify for simplified issue with substantial coverage.

Case Study 2: Linda, Age 72 – Congestive Heart Failure

Heart Condition:

- CHF diagnosed 18 months ago

- Ejection fraction: 35% (reduced)

- Takes multiple heart medications

- Has shortness of breath with exertion

- Hospitalized once in past year

- Still managing symptoms

What She Did: Linda knew her active CHF would disqualify her from simplified issue. She applied for guaranteed issue coverage through Gerber Life, which asks no health questions.

Result: Automatically approved for $15,000 coverage at $112/month. Two-year waiting period applies for natural death. Perfect for covering her final expenses.

Key Takeaway: Even with serious, ongoing heart conditions, guaranteed issue policies ensure you can get coverage.

Case Study 3: Richard, Age 65 – Bypass Surgery 7 Years Ago

Heart Condition:

- Triple bypass surgery 7 years ago

- Excellent recovery with no complications

- Lost 40 pounds and exercises regularly

- Normal stress test results

- Only takes one cholesterol medication

- No symptoms whatsoever

What He Did: Richard worked with an independent agent who suggested trying for fully underwritten coverage given his excellent long-term recovery. He completed a medical exam including EKG and blood work.

Result: Approved by Banner Life for $500,000 in 20-year term at $298/month (standard rates). His disciplined recovery and time since surgery earned him competitive pricing.

Key Takeaway: If your heart event was many years ago with perfect recovery, traditional underwriting might offer the best rates.

Case Study 4: Barbara, Age 76 – Recent Heart Attack

Heart Condition:

- Heart attack 4 months ago

- Underwent angioplasty

- Still in cardiac rehabilitation

- Takes 5 heart medications

- Anxiety about health

- Worried about leaving debts for children

What She Did: Barbara couldn’t wait years to apply. She needed coverage now to protect her family. She applied for guaranteed issue through Mutual of Omaha.

Result: Approved immediately for $20,000 coverage at $145/month. While there’s a waiting period, she has peace of mind knowing her funeral will be covered (accidental death covered immediately) and her full benefit kicks in after 2 years.

Key Takeaway: Recent heart events don’t disqualify you—guaranteed issue provides immediate protection with a waiting period.

How Much Does Life Insurance Cost With Heart Disease?

Let’s talk real numbers. Your costs will vary based on several factors, but here’s what you can expect:

Monthly Premium Estimates for $100,000 Coverage

Simplified Issue Policies:

| Age | Mild Heart Disease (5+ years ago) | Moderate (2-5 years ago) | Recent/Severe |

|---|---|---|---|

| 60 | $185-$245 | $245-$325 | Often declined |

| 65 | $235-$305 | $305-$405 | Often declined |

| 70 | $315-$415 | $415-$545 | Often declined |

| 75 | $445-$585 | $585-$765 | Often declined |

Guaranteed Issue Policies (for $10,000-$15,000 coverage):

| Age | Monthly Premium Range |

|---|---|

| 60 | $55-$85 |

| 65 | $70-$105 |

| 70 | $90-$135 |

| 75 | $120-$175 |

| 80 | $160-$230 |

Important Notes:

- Women typically pay 20-30% less than men

- Non-smokers save 40-60% compared to smokers

- The better your recovery and management, the better your rates

- Multiple health conditions increase costs significantly

Factors That Impact Your Approval and Cost

Premium Reducers (Things That Help You):

✓ Time Since Last Cardiac Event: The longer ago, the better ✓ Complete Recovery: No symptoms or complications ✓ Medication Compliance: Taking prescribed medications as directed ✓ Smoking Cessation: Quitting smoking dramatically improves eligibility ✓ Regular Doctor Visits: Shows you’re managing your health ✓ Good Test Results: Normal stress tests, good ejection fraction ✓ Weight Management: Maintaining healthy BMI ✓ Exercise Program: Doctor-approved cardiac rehabilitation ✓ Only One Event: No repeat heart attacks or procedures

Premium Increasers (Things That Hurt You):

✗ Recent Cardiac Event: Within past 6-12 months ✗ Multiple Heart Attacks: Pattern of recurring problems ✗ Low Ejection Fraction: Below 40% is concerning ✗ Active Symptoms: Ongoing chest pain or shortness of breath ✗ Poor Medication Compliance: Missing doses or non-adherence ✗ Continued Smoking: This is the biggest red flag ✗ Multiple Comorbidities: Diabetes, kidney disease, COPD, etc. ✗ Recent Hospitalization: Hospital stays in past year ✗ Poor Test Results: Abnormal stress tests or imaging

Step-by-Step: Getting Approved With Heart Disease

Step 1: Gather Your Medical Information

Before applying, collect:

- Dates of all cardiac events (heart attacks, surgeries, procedures)

- Names and dosages of all heart medications

- Most recent cardiologist visit notes

- Latest test results (stress test, echocardiogram, EKG)

- Ejection fraction if you have CHF

- List of any hospitalizations in past 2 years

- Current symptoms (if any)

Having this information ready makes the application process smooth and shows insurers you’re organized and serious about your health.

Step 2: Determine Your Best Policy Type

Ask yourself:

- How long ago was my last cardiac event?

- Have I had complications or symptoms recently?

- Am I able to answer health questions honestly without disqualifying myself?

- Do I need coverage over $25,000?

If your heart event was 2+ years ago with good recovery: Try simplified issue first

If you have active symptoms or recent events: Go straight to guaranteed issue

If you’re unsure: Work with an independent agent who can assess your situation

Step 3: Calculate Coverage Needs

How much do you actually need?

For Final Expenses Only:

- Funeral and burial: $8,000-$12,000

- Outstanding medical bills: $5,000-$15,000

- Total needed: $15,000-$25,000

- Best option: Guaranteed issue

For Debt Protection:

- Final expenses: $10,000-$15,000

- Credit cards/loans: $10,000-$30,000

- Portion of mortgage: $50,000-$100,000

- Total needed: $70,000-$145,000

- Best option: Simplified issue if qualified

For Income Replacement/Legacy:

- Everything above, plus

- Support family for 2-5 years

- Total needed: $150,000-$500,000

- Best option: Simplified or traditional if excellent recovery

Step 4: Choose Heart-Friendly Insurance Companies

Not all insurers view heart disease the same way. Some are much more accommodating:

Most Lenient for Heart Disease:

- Mutual of Omaha – Accepts a wide range of cardiac conditions

- AIG – Good for stable heart disease 2+ years post-event

- Foresters Financial – Simplified issue with flexible underwriting

- Assurity – Reasonable rates for managed heart conditions

For Guaranteed Issue:

- Gerber Life – Up to $25,000, ages 50-80

- Colonial Penn – Well-established guaranteed acceptance

- Mutual of Omaha – Up to $25,000, ages 45-85

- SBLI – Simplified and guaranteed options

Step 5: Be Completely Honest on Your Application

I cannot stress this enough: tell the truth.

Insurance companies will verify your information through:

- Medical Information Bureau (MIB)

- Prescription drug databases

- Your medical records (with authorization)

- Attending Physician Statements (APS)

Lying about your heart condition will result in:

- Immediate application denial

- Policy cancellation if discovered later

- Claim denial when your family needs it most

- Possible fraud investigation

If you’re worried about being honest because you think you’ll be declined, remember: guaranteed issue policies exist specifically for people with serious health conditions. There’s always an option.

Step 6: Consider Working With an Independent Agent

Independent insurance agents can be invaluable when you have heart disease because they:

- Know which companies are most lenient for specific conditions

- Can shop multiple insurers simultaneously

- Understand underwriting guidelines intimately

- Can position your application favorably

- Help you avoid unnecessary declines

- Cost you nothing (paid by insurance companies)

Especially if your heart condition is complex or you have multiple health issues, an experienced agent can save you time, money, and frustration.

Special Considerations for Different Heart Conditions

Getting Life Insurance after Heart Attack (Myocardial Infarction)

Waiting Periods:

- Most simplified issue: 12-24 months after event

- Some companies: 6 months if minor and excellent recovery

- Guaranteed issue: Can apply immediately

What Helps Approval:

- Only one heart attack (not multiple)

- Minimal heart muscle damage

- Normal ejection fraction (50%+)

- Successful treatment with no complications

- Smoking cessation if you smoked

Getting Life Insurance After Stent Placement or Angioplasty

Generally More Favorable than heart attack alone because:

- Procedure restored blood flow

- Less heart damage typically

- Shows proactive treatment

Waiting Period:

- Simplified issue: Usually 6-12 months post-procedure

- Better rates: 2+ years with no complications

What They’ll Ask:

- Number of stents placed

- Which arteries were treated

- Any restenosis (re-narrowing)

- Current symptoms

Getting Life Insurance After Bypass Surgery (CABG)

Waiting Period:

- Simplified issue: 12-24 months minimum

- Best rates: 3-5 years with perfect recovery

What Improves Approval:

- Successful grafts with good blood flow

- Significant lifestyle changes made

- Regular follow-up care

- No angina or symptoms

- Excellent stress test results

Getting Life Insurance after Congestive Heart Failure (CHF)

Most Challenging but not impossible:

Ejection Fraction Matters Most:

- Above 50% (preserved): Simplified issue possible after 1-2 years

- 40-50% (mildly reduced): Guaranteed issue likely needed

- Below 40% (reduced): Guaranteed issue your best bet

- Below 30% (severely reduced): Guaranteed issue only option

What Companies Look For:

- Stability of condition

- Medication compliance

- Hospitalizations (fewer is better)

- Symptom management

- Underlying cause addressed

Getting Life Insurance after Atrial Fibrillation (AFib)

Good News: AFib alone is very manageable for insurance

If Well-Controlled:

- Simplified issue highly likely

- Some may qualify for traditional underwriting

- Rates not dramatically increased

What They Want to See:

- Type of AFib (paroxysmal better than persistent)

- On anticoagulation therapy

- Regular monitoring

- No stroke history

- Heart rate controlled

Getting Life Insurance with Stable Angina

Manageable Condition if stable:

For Approval:

- No angina episodes with medication

- No recent changes in symptoms

- Stress test shows no ischemia

- Following treatment plan

Waiting Period:

- Simplified issue: Often approved with stable angina

- Better rates: 1-2 years of stability

Top 5 Mistakes to Avoid

Mistake #1: Waiting Too Long to Apply

Every year you wait:

- You get older (premiums increase 8-12% per year)

- Your heart condition may worsen

- New health issues may develop

- Coverage becomes harder to get

Better Approach: Apply as soon as you’re medically stable and past any required waiting period.

Mistake #2: Applying to the Wrong Company

Different insurers have vastly different underwriting standards. Applying to a company that’s strict about heart conditions wastes time and creates a denial on your record.

Better Approach: Research company-specific guidelines or work with an agent who knows which insurers are heart-friendly.

Mistake #3: Not Disclosing Your Full Medical History

Some people think they can hide old heart issues or leave out details. Bad idea.

Better Approach: Full disclosure always. If you’re worried about being declined, that’s exactly why guaranteed issue exists.

Mistake #4: Buying Too Little Coverage

Many seniors with heart disease settle for small guaranteed issue policies when they actually qualify for more coverage through simplified issue.

Better Approach: At least get quotes for simplified issue before defaulting to guaranteed issue.

Mistake #5: Ignoring Group Life Insurance Options

If you’re still employed or part of any organization, you might have access to group life insurance that doesn’t require medical underwriting.

Better Approach: Check with:

- Current or former employers

- Professional associations

- Alumni organizations

- AARP or senior groups

- Union memberships

Understanding the Waiting Period

If you’re considering guaranteed issue or graded benefit policies, the waiting period can be confusing. Let me break it down:

How It Works:

Years 1-2 (Waiting Period):

- Accidental Death: Full benefit paid immediately

- Death from Illness: Return of all premiums paid + 10% interest

Year 3+ (After Waiting Period):

- Any Cause of Death: Full benefit paid

Real Example:

Sarah, age 73 with recent CHF, buys $15,000 guaranteed issue policy at $105/month.

Scenario 1 – Dies in Year 1 from heart failure:

- Paid 12 months × $105 = $1,260 in premiums

- Beneficiaries receive: $1,260 + 10% interest = $1,386

Scenario 2 – Dies in Year 1 from car accident:

- Beneficiaries receive: Full $15,000 (accidents covered immediately)

Scenario 3 – Dies in Year 3 from any cause:

- Beneficiaries receive: Full $15,000

Is the Waiting Period Worth It?

YES, if:

- You’ve been declined elsewhere

- You have serious active heart disease

- You need coverage for final expenses

- You want peace of mind now

MAYBE NOT, if:

- You qualify for simplified issue (no waiting period)

- You need large coverage amounts immediately

- Your heart condition is well-managed

Frequently Asked Questions

Can I get life insurance after a heart attack?

Yes, absolutely. The key factors are how long ago it occurred and how well you’ve recovered. Most simplified issue companies require you to wait 6-24 months after a heart attack before applying. If it’s been 2+ years with good recovery and no complications, you have excellent chances of approval. If your heart attack was recent (within 6 months), guaranteed issue policies will accept you immediately, though they come with a 2-3 year waiting period for natural death coverage.

How long after stent placement can I get life insurance?

Most insurance companies want you to wait at least 6-12 months after stent placement before applying for simplified issue coverage. This waiting period allows them to see that the stent is working properly and you’re not having complications. If it’s been 2+ years since your stent placement with no restenosis (re-narrowing) or additional procedures, your approval odds and rates improve significantly. For immediate coverage, guaranteed issue policies are available right after stent placement with no waiting period to apply.

Can I get life insurance with congestive heart failure?

Yes, though your options depend on severity. If you have CHF with an ejection fraction above 50% and it’s been stable for 1-2 years, some simplified issue companies may consider you. However, most people with CHF find guaranteed issue life insurance to be their best option. These policies accept all applicants regardless of heart conditions, offer coverage from $5,000-$25,000, and come with a 2-3 year waiting period. The good news is accidental death is covered immediately, and after the waiting period, the full benefit applies to any cause of death.

Will life insurance cover death from heart disease if I had a pre-existing condition?

Yes, as long as you were honest on your application. Pre-existing conditions do not prevent your beneficiaries from collecting the death benefit. If you have guaranteed issue coverage, once you pass the 2-3 year waiting period, death from heart disease is fully covered. With simplified issue or traditional policies, there’s no waiting period—death from heart disease is covered from day one. The only way a claim gets denied is if you lied about your heart condition on the application, which is why honesty is absolutely critical.

Is life insurance more expensive if you’ve had heart bypass surgery?

Yes, life insurance will be more expensive than for someone without heart disease, but it’s definitely obtainable. The cost depends on how long ago your bypass was and how well you’ve recovered. If your bypass was 5+ years ago with excellent recovery and no complications, you might pay 30-50% more than standard rates. If it was 2-3 years ago, expect to pay 50-100% more. Recent bypass surgery (within 1-2 years) typically means guaranteed issue is your only option, where costs are higher but acceptance is guaranteed. The good news is rates are locked in, so as long as you pay your premiums, your cost never increases.

Can I be denied life insurance because of atrial fibrillation?

Atrial fibrillation (AFib) alone rarely causes outright denial, especially for simplified or guaranteed issue policies. AFib is one of the more “insurance-friendly” heart conditions because it’s very common and manageable with medication. If your AFib is well-controlled with anticoagulation therapy and you have no history of stroke, you’ll likely be approved for simplified issue coverage with only modest premium increases. Even if your AFib is poorly controlled or you have other heart conditions, guaranteed issue policies cannot deny you. Traditional fully underwritten policies are more strict, but many people with stable AFib still qualify.

Should I wait for my heart condition to improve before applying for life insurance?

This is tricky. If your heart event was very recent (within 1-3 months) and you’re still in recovery, waiting a few months until you’re stable might help you qualify for better coverage options. However, waiting years for your condition to improve is generally not advisable because: (1) you’ll be older and premiums increase with age, (2) new health issues could develop, and (3) you’re leaving your family unprotected during that time. A better strategy is to get guaranteed issue coverage now for immediate protection, then reapply for better rates once your condition improves. You can always upgrade your coverage later.

What heart medications will disqualify me from life insurance?

No heart medications automatically disqualify you from all life insurance. However, certain medications signal serious conditions that may limit you to guaranteed issue coverage. For example, taking multiple heart medications (beta blockers + ACE inhibitors + diuretics + anticoagulants) suggests more serious heart disease. That said, guaranteed issue policies ask NO questions about medications whatsoever. Simplified issue companies typically ask what medications you take, but taking standard heart medications like statins, blood pressure drugs, or even blood thinners won’t necessarily disqualify you—they just factor into the underwriting decision.

Can I get life insurance if I’m still smoking with heart disease?

Yes, but it severely limits your options and dramatically increases your cost. Smoking with heart disease is the worst combination from an insurance perspective. Most simplified issue companies will decline smokers with heart disease, meaning guaranteed issue becomes your primary option. The good news is guaranteed issue policies accept smokers without asking about tobacco use. If you can quit smoking for 12 months, your options improve significantly. Even quitting for 6 months shows insurers you’re serious about your health, which can help with approval chances and rates.

How much life insurance can I get with heart disease?

This depends entirely on the severity of your condition and type of policy. With guaranteed issue coverage, you’re typically limited to $5,000-$25,000, which is perfect for final expenses. With simplified issue coverage (if you qualify), you can often get $50,000-$250,000, sometimes up to $500,000 depending on the company and your specific situation. If your heart condition was minor and occurred many years ago with perfect recovery, traditional fully underwritten policies might offer $500,000 to several million dollars. The key is matching your health profile to the right policy type.

No. Once you’re approved for life insurance with level premiums (most whole life and term life policies), your rates are locked in for life or the term of the policy. Even if your heart disease worsens, you have another heart attack, or you develop new health conditions, your premium cannot be increased as long as you continue paying on time. This is exactly why getting coverage sooner rather than later is so important—you lock in rates at your current health status before things potentially worsen. The only exception is if you have a term policy that renews after the term ends, at which point rates would be recalculated.

Should I get term or whole life insurance with heart disease?

For most seniors with heart disease, whole life insurance is the better choice. Here’s why: (1) Whole life covers you for your entire lifetime, while term expires after 10-30 years when you might be uninsurable, (2) Whole life builds cash value you can borrow against, (3) Premiums stay level for life, and (4) Most guaranteed issue and simplified issue policies for seniors are whole life anyway. Term life insurance can work if you only need coverage temporarily (like until your mortgage is paid off) and your heart disease is very well-managed. However, if your health worsens, you won’t be able to renew or get new coverage after the term ends.

Taking Action: Your Next Steps

Getting life insurance with heart disease is completely achievable—you just need to approach it strategically. Here’s your action plan:

This Week:

- Gather all your cardiac medical records and test results

- Make a list of all your heart medications with dosages

- Note the dates of any heart events (attacks, surgeries, procedures)

- Calculate how much coverage you actually need

This Month:

- Determine which policy type fits your situation best

- Get quotes from at least 3-5 insurance companies

- Consider speaking with an independent insurance agent

- Check if you have any group life insurance options available

Before Applying:

- Be prepared to answer all health questions honestly

- Have your cardiologist’s contact information ready

- Understand any waiting periods if choosing guaranteed issue

- Choose your beneficiaries

Remember:

- Every day you wait, you’re getting older and premiums are increasing

- Your heart condition could potentially worsen

- Your family deserves the financial protection today, not years from now

Don’t let heart disease prevent you from securing your family’s financial future. Whether you need $10,000 for final expenses or $250,000 to pay off your mortgage, options exist for your situation.

Conclusion: You Have Options

Living with heart disease doesn’t mean you can’t protect your family with life insurance. From simplified issue policies for those with stable conditions to guaranteed issue coverage for anyone with any heart condition, there’s a solution that fits your needs.

The key points to remember:

✓ Time helps: The longer since your cardiac event, the better your options ✓ Management matters: Taking your medications and following doctor’s orders improves approval ✓ Honesty is essential: Never lie about your heart condition on applications ✓ Options exist: Even with severe heart disease, guaranteed issue ensures coverage ✓ Compare companies: Not all insurers view heart disease the same way ✓ Act now: Waiting only makes coverage more expensive and harder to get

You’ve taken care of your heart health—now take care of your family’s financial health. Start comparing quotes today and take the first step toward the peace of mind you and your loved ones deserve.

Disclaimer: This article provides general information about life insurance options for seniors with heart disease and should not be considered medical, financial, or legal advice. Life insurance availability, rates, and underwriting guidelines vary significantly by company, state, individual health circumstances, and specific heart condition details. Premium estimates provided are approximate and for illustrative purposes only. Always consult with licensed insurance professionals and your healthcare providers when making insurance decisions. Individual results may vary based on age, gender, specific cardiac diagnosis, treatment history, medications, overall health, and other factors assessed during underwriting.