Best Life Insurance Companies for Seniors 2025: Complete Comparison Guide

Finding the best life insurance companies for seniors isn’t as simple as looking at the biggest names in the insurance industry. What works for a 30-year-old healthy professional rarely works for a 70-year-old retiree with diabetes and high blood pressure.

Seniors need insurers that specialize in no-exam policies, understand health conditions, offer affordable rates for older ages, and actually approve applications without endless hoops to jump through.

After 15+ years helping seniors secure life insurance coverage, I’ve worked with dozens of insurance companies and seen which ones truly deliver for older Americans. Some companies market heavily to seniors but have terrible approval rates.

Others offer great coverage but charge premiums that strain fixed incomes. And a few stand out as genuinely excellent choices that combine fair pricing, easy approval, and reliable claims payment.

In this comprehensive guide, I’ll reveal the top life insurance companies for seniors based on real-world performance, not marketing hype. You’ll discover which best senior life insurance companies excel at covering people with health conditions, which offer the lowest rates for your age, and which provide the smoothest application experience.

Whether you’re 60 or 85, managing chronic conditions or in perfect health, you’ll learn exactly which insurers deserve your business.

I’ll compare the life insurance companies for seniors over 70 on the factors that actually matter: acceptance rates, premium costs, coverage amounts, financial strength, customer service, and claims payment speed. By the end of this guide, you’ll know which companies to call first and which to avoid, saving you time, money, and frustration.

Let’s find you the right coverage from the right company—one that will still be around to pay your beneficiaries when the time comes.

What Makes a Life Insurance Company “Best” for Seniors?

Before diving into specific companies, let’s establish what separates the best life insurance for elderly from mediocre options. Seniors have unique needs that differ dramatically from younger buyers.

Key Criteria for Senior-Friendly Insurers:

1. No Medical Exam Options

- Simplified issue (health questions only)

- Guaranteed issue (no health questions at all)

- Fast approval process (24-48 hours vs weeks)

- Available at older ages (80-85+)

Why It Matters: Most seniors have health conditions that complicate traditional underwriting. The best companies make coverage accessible without doctor visits, blood work, or invasive medical exams.

2. Health Condition Acceptance

- Accepts diabetes, heart disease, COPD

- Covers cancer survivors after waiting periods

- Approves high blood pressure cases

- Works with oxygen users and serious conditions

Why It Matters: If a company declines 70% of senior applicants, it’s not senior-friendly regardless of rates. The best insurers understand senior health realities.

3. Age-Appropriate Coverage Amounts

- $5,000-$50,000 final expense policies

- Options up to $100,000-$300,000 for younger seniors

- Flexibility to buy what you need (not forced minimums)

Why It Matters: Seniors don’t typically need $1 million policies. The best companies focus on realistic coverage for funeral costs and final expenses.

4. Affordable Premiums for Fixed Incomes

- Competitive rates for ages 60-85

- Transparent pricing (no hidden fees)

- Level premiums (never increase)

- Multiple payment options (monthly, quarterly, annual)

Why It Matters: Premium affordability on a fixed income determines whether you can maintain coverage long-term.

5. Strong Financial Ratings

- A.M. Best rating of A- or higher

- 50+ years in business preferred

- Proven claims payment history

- State insurance department good standing

Why It Matters: Your insurer must be financially stable enough to pay claims 10-20 years from now when your beneficiaries need it.

6. Excellent Customer Service

- Dedicated senior support

- Clear policy explanations

- Easy beneficiary changes

- Responsive claims department

Why It Matters: Seniors shouldn’t struggle with confusing paperwork, unhelpful phone representatives, or complicated processes.

7. Fast Claims Payment

- Average payout within 30-60 days

- Low dispute rate

- Simple claims process for beneficiaries

- Direct deposit options

Why It Matters: Your family shouldn’t wait months for funeral expense money or face unnecessary red tape during grief.

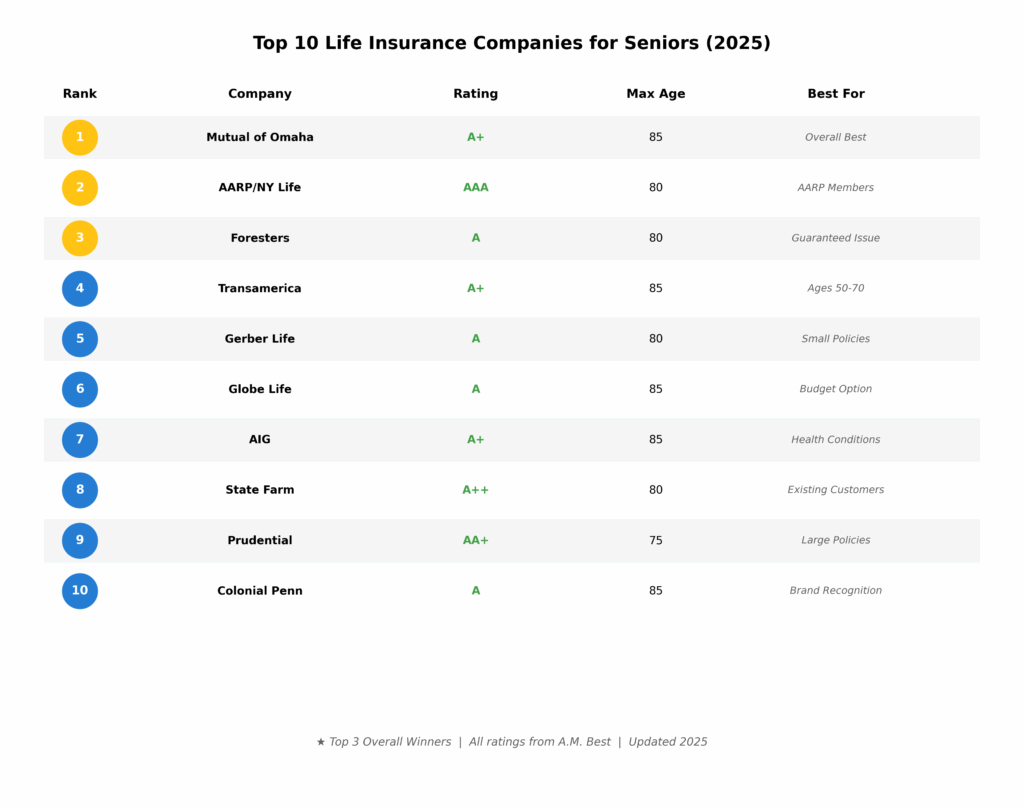

The 10 Best Life Insurance Companies for Seniors (2025 Rankings)

Based on the criteria above, here are the best senior life insurance companies ranked by overall value for seniors. Each has specific strengths that make them excellent choices for different situations.

#1. Mutual of Omaha – Best Overall for Seniors

Why They’re #1: Mutual of Omaha consistently ranks as the best overall choice because they excel across all categories. They offer both simplified issue and guaranteed issue policies, accept most health conditions, provide competitive rates, and have been in business since 1909 with an A+ financial strength rating.

Key Strengths:

- Guaranteed issue up to age 85

- Simplified issue for healthier seniors

- Coverage from $2,000 to $50,000

- Fast online application (10 minutes)

- Excellent customer service ratings

- Accepts diabetes, heart disease, COPD

- Coverage available in all 50 states

Sample Rates (Guaranteed Issue, $15,000):

- Age 65 Female: $89/month

- Age 70 Male: $135/month

- Age 75 Female: $142/month

- Age 80 Male: $245/month

Best For: Seniors seeking reliable coverage from a financially strong company with fair pricing and easy approval.

Potential Drawback: Guaranteed issue has 2-year waiting period (industry standard).

#2. AARP/New York Life – Best for Members

Why They Rank #2: The AARP-endorsed life insurance through New York Life offers exceptional value for AARP members with competitive group rates, simplified underwriting, and the backing of New York Life’s AAA financial strength rating.

Key Strengths:

- Group rates for AARP members (save 10-20%)

- Simplified issue up to $100,000

- No medical exam required

- Coverage to age 80

- Excellent claims payment record

- Level premiums for life

- Backed by New York Life (established 1845)

Sample Rates (Simplified Issue, $50,000):

- Age 60 Female: $95/month

- Age 65 Male: $145/month

- Age 70 Female: $195/month

- Age 75 Male: $295/month

Best For: AARP members seeking larger coverage amounts with simplified underwriting.

Potential Drawback: Requires AARP membership ($16/year). Not available for guaranteed issue (must answer health questions).

#3. Foresters Financial – Best Guaranteed Issue

Why They Rank #3: Foresters specializes in guaranteed acceptance policies and makes the process incredibly simple. They accept everyone regardless of health conditions, offer instant online approval, and include member benefits like scholarship programs for grandchildren.

Key Strengths:

- True guaranteed acceptance (no health questions)

- Instant approval online

- Coverage from $5,000 to $30,000

- Ages 40-80 eligible

- Member benefits (scholarships, discounts)

- A rating from A.M. Best

- Simple application (5 minutes online)

Sample Rates (Guaranteed Issue, $15,000):

- Age 65 Female: $95/month

- Age 70 Male: $148/month

- Age 75 Female: $155/month

- Age 80 Male: $265/month

Best For: Seniors with serious health conditions who need guaranteed acceptance without medical questions.

Potential Drawback: 2-year waiting period for natural causes (accidental death covered immediately).

#4. Transamerica – Best for Younger Seniors (50-70)

Why They Rank #4: Transamerica offers some of the best rates for younger, healthier seniors (ages 50-70) and provides larger coverage amounts up to $300,000 with simplified underwriting.

Key Strengths:

- Excellent rates for ages 50-70

- Coverage up to $300,000 available

- Simplified issue (no medical exam)

- Fast approval (24-48 hours)

- A+ financial strength rating

- Online application available

- Term and permanent options

Sample Rates (Simplified Issue, $100,000):

- Age 60 Female: $125/month

- Age 65 Male: $195/month

- Age 70 Female: $285/month

- Age 75 Male: $425/month

Best For: Younger seniors (50-70) in relatively good health seeking larger coverage amounts.

Potential Drawback: More restrictive health questions than guaranteed issue options. Not available over age 85.

#5. Gerber Life – Best for Small Policies

Why They Rank #5: Gerber Life specializes in affordable small policies ($5,000-$25,000) with guaranteed acceptance, making them perfect for seniors who just want funeral expenses covered without overpaying.

Key Strengths:

- Small policy focus ($5,000-$25,000)

- Guaranteed acceptance ages 50-80

- Very simple application (3 minutes)

- Budget-friendly for fixed incomes

- Coverage starts day one for accidents

- Easy online or phone application

- Good customer service ratings

Sample Rates (Guaranteed Issue, $10,000):

- Age 65 Female: $58/month

- Age 70 Male: $88/month

- Age 75 Female: $98/month

- Age 80 Male: $165/month

Best For: Seniors seeking just enough coverage for funeral costs without unnecessary extra.

Potential Drawback: Maximum coverage only $25,000 (not enough for those with significant debts).

#6. Globe Life – Best Budget Option

Why They Rank #6: Globe Life often offers the lowest premiums in the industry, making them ideal for budget-conscious seniors. They’ve been in business since 1951 and maintain an A rating.

Key Strengths:

- Often lowest premiums available

- Coverage from $5,000 to $100,000

- Both simplified and guaranteed issue

- Ages 50-85 accepted

- A financial strength rating

- No waiting period on some policies

- Fast online quotes

Sample Rates (Guaranteed Issue, $15,000):

- Age 65 Female: $82/month

- Age 70 Male: $128/month

- Age 75 Female: $135/month

- Age 80 Male: $228/month

Best For: Price-conscious seniors seeking the absolute lowest premium for comparable coverage.

Potential Drawback: Customer service reviews are mixed. Some complaints about claim delays.

#7. AIG (American General) – Best for Health Conditions

Why They Rank #7: AIG excels at approving seniors with managed health conditions through their simplified issue products. They’re particularly good for diabetes, controlled blood pressure, and heart disease cases.

Key Strengths:

- Excellent approval rates for health conditions

- Simplified issue (no exam)

- Coverage to $100,000

- Accepts well-managed chronic conditions

- Fast underwriting (48-72 hours)

- A+ financial rating

- Competitive rates for health issues

Sample Rates (Simplified Issue, $25,000, Controlled Diabetes):

- Age 65 Female: $98/month

- Age 70 Male: $155/month

- Age 75 Female: $215/month

- Age 80 Male: $325/month

Best For: Seniors with diabetes, high blood pressure, or heart disease that’s well-controlled with medication.

Potential Drawback: Requires detailed health questions (not guaranteed issue). Can decline unhealthy applicants.

#8. State Farm – Best for Existing Customers

Why They Rank #8: State Farm offers solid life insurance options and provides convenience for seniors who already have auto or home insurance with them. Bundling can provide small discounts and simplifies account management.

Key Strengths:

- Convenient for existing customers

- Simplified issue available

- Local agent support

- Multiple policy discounts

- Financially strong (A++ rating)

- Good reputation for claims payment

- Coverage to age 80

Sample Rates (Simplified Issue, $25,000):

- Age 65 Female: $105/month

- Age 70 Male: $168/month

- Age 75 Female: $235/month

- Age 80 Male: $355/month

Best For: Seniors who already have State Farm auto/home insurance and want local agent support.

Potential Drawback: Rates slightly higher than specialized senior insurers. Limited guaranteed issue options.

#9. Prudential – Best for Larger Policies

Why They Rank #9: Prudential excels at providing larger coverage amounts ($100,000-$500,000) for younger, healthier seniors who need comprehensive protection beyond just funeral expenses.

Key Strengths:

- Large coverage amounts available

- Simplified issue up to $500,000

- Excellent financial strength (AA+ rating)

- Good for mortgage protection needs

- Established 1875

- Strong claims payment record

- Multiple policy type options

Sample Rates (Simplified Issue, $250,000):

- Age 60 Female: $285/month

- Age 65 Male: $425/month

- Age 70 Female: $595/month

- Age 75 Male: $895/month

Best For: Younger seniors (60-75) needing large coverage amounts for mortgage payoff or income replacement.

Potential Drawback: Higher premiums than final expense specialists. More stringent health requirements.

#10. Colonial Penn – Best Brand Recognition

Why They Rank #10: Colonial Penn is heavily advertised and well-known among seniors, offering guaranteed acceptance up to age 85. While not the cheapest, their brand familiarity provides comfort for some buyers.

Key Strengths:

- Heavy advertising/brand recognition

- Guaranteed acceptance ages 50-85

- Units system (buy in $5,000 increments)

- Simple application process

- Nationwide availability

- Established reputation

- Easy to understand products

Sample Rates (Guaranteed Issue, $15,000):

- Age 65 Female: $98/month

- Age 70 Male: $152/month

- Age 75 Female: $168/month

- Age 80 Male: $278/month

Best For: Seniors who value brand familiarity and straightforward policies over absolute lowest price.

Potential Drawback: Premiums higher than competitors. Units pricing system can be confusing for some.

Detailed Comparison: Rates by Age and Company

Let’s compare actual monthly premiums for $15,000 guaranteed issue coverage across the best life insurance companies for seniors to see who offers the best value at different ages.

Female Non-Smoker Rates ($15,000 Coverage):

| Company | Age 65 | Age 70 | Age 75 | Age 80 |

|---|---|---|---|---|

| Mutual of Omaha | $89 | $118 | $142 | $245 |

| Foresters | $95 | $125 | $155 | $265 |

| Gerber ($10K) | $58 | $75 | $98 | $165 |

| Globe Life | $82 | $110 | $135 | $228 |

| Colonial Penn | $98 | $128 | $168 | $278 |

| AARP/NY Life | N/A | N/A | N/A | N/A |

AARP rates require health questions (simplified issue), not guaranteed issue

Male Non-Smoker Rates ($15,000 Coverage):

| Company | Age 65 | Age 70 | Age 75 | Age 80 |

|---|---|---|---|---|

| Mutual of Omaha | $118 | $135 | $188 | $298 |

| Foresters | $125 | $148 | $198 | $325 |

| Gerber ($10K) | $75 | $88 | $125 | $215 |

| Globe Life | $108 | $128 | $178 | $288 |

| Colonial Penn | $125 | $152 | $215 | $345 |

| AARP/NY Life | N/A | N/A | N/A | N/A |

Key Insights:

Cheapest Overall: Globe Life and Mutual of Omaha consistently offer the lowest premiums across ages.

Best Value Age 65-75: Globe Life edges out others for younger seniors, saving $10-20/month.

Best Value Age 80+: Mutual of Omaha offers better rates for the oldest seniors compared to competitors.

Small Policy Value: Gerber Life ($10K coverage) provides excellent value if you only need funeral coverage.

Rate Differences: Premiums can vary by $50-100/month between most and least expensive companies at age 80—a difference of $600-$1,200 annually.

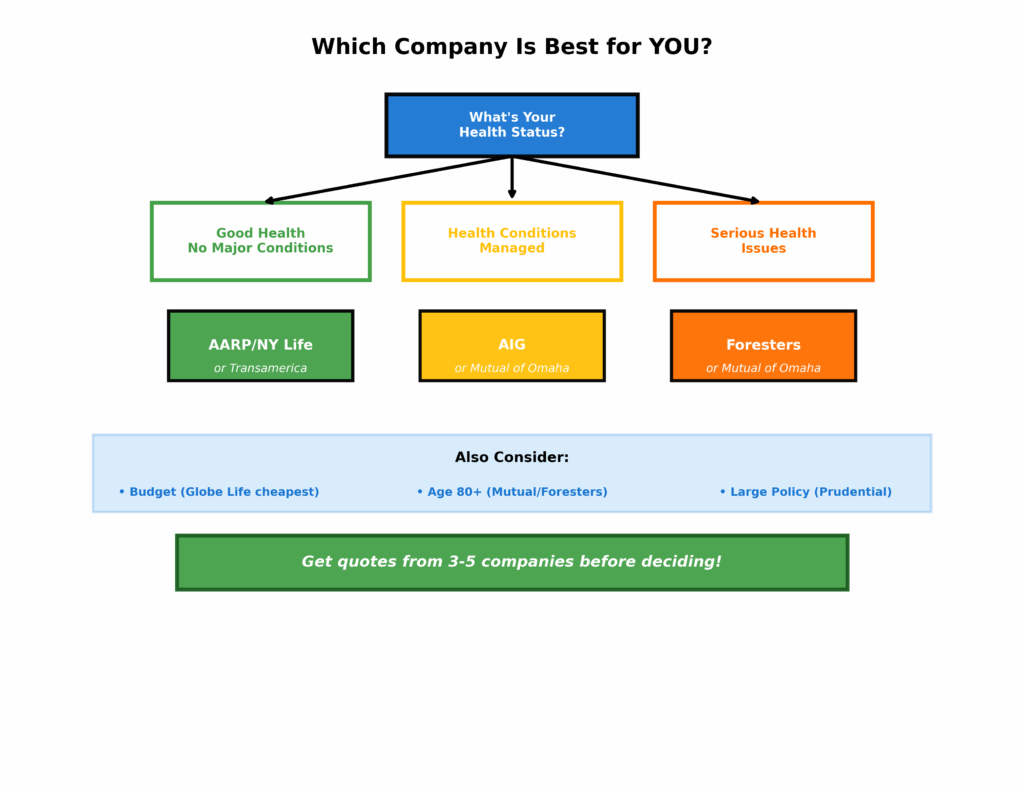

Which Company Is Best for Your Specific Situation?

The life insurance companies for seniors over 70 that work best depend on your individual circumstances. Here’s how to choose based on your situation:

If You’re in Good Health (No Major Conditions):

Best Choice: AARP/New York Life or Transamerica

- Lowest rates for healthy seniors

- Simplified issue (answer health questions)

- Larger coverage amounts available

- No waiting periods

Strategy: Apply for simplified issue first. If declined, switch to guaranteed issue.

If You Have Diabetes, High Blood Pressure, or Heart Disease:

Best Choice: AIG (American General) or Mutual of Omaha

- Excellent approval rates for managed conditions

- Fair pricing for health issues

- Simplified issue available

- Experienced underwriters who understand conditions

Strategy: Have A1C levels, blood pressure readings, and medication lists ready when applying.

If You Have Serious Health Conditions (COPD, Oxygen, Cancer):

Best Choice: Foresters Financial or Mutual of Omaha

- Guaranteed acceptance regardless of health

- No medical questions asked

- Instant approval

- Accept oxygen users, severe COPD, recent cancer

Strategy: Choose guaranteed issue—don’t waste time with companies that will decline you.

If You’re Over Age 80:

Best Choice: Mutual of Omaha or Foresters

- Accept applicants to age 85

- Competitive rates for oldest seniors

- Guaranteed issue available

- Established reputation

Strategy: Apply soon—fewer companies cover age 85+. Don’t wait.

If You’re on a Tight Budget:

Best Choice: Globe Life or Gerber Life (small policies)

- Lowest premiums available

- Small policy amounts keep costs down

- Guaranteed acceptance

- Budget-friendly for fixed incomes

Strategy: Buy only what you need for funeral expenses ($10K-$15K) to minimize premiums.

If You Need Large Coverage ($100K+):

Best Choice: Prudential or Transamerica

- Coverage up to $500,000

- Simplified issue available

- Good for mortgage payoff

- Competitive rates for large amounts

Strategy: Must be younger (under 75) and relatively healthy for large amounts.

If You Want the Easiest Application:

Best Choice: Foresters Financial or Gerber Life

- Online application in 5 minutes

- Instant approval

- No phone calls or paperwork

- Completely digital process

Strategy: Apply online directly—skip agents and phone calls entirely.

If You Value Local Agent Support:

Best Choice: State Farm or Mutual of Omaha

- Local offices in most areas

- Face-to-face meetings available

- Agent helps with paperwork

- Personal relationship

Strategy: Find a local agent who specializes in senior life insurance, not just auto insurance.

Red Flags: Companies to Avoid

While focusing on the top life insurance companies for seniors, it’s equally important to recognize warning signs of companies that aren’t senior-friendly:

Warning Signs of Problem Companies:

1. Excessive Advertising But Poor Reviews

- Heavy TV advertising during senior programming

- But consistent complaints about claims denials

- Multiple state insurance department violations

- Poor Better Business Bureau ratings

Example: Some heavily advertised companies have claim denial rates 3-4X higher than industry average.

2. Unclear Pricing or Hidden Fees

- Won’t quote rates without extensive personal information

- “Units” pricing that confuses actual costs

- Policy fees, administrative charges not disclosed upfront

- Rates that mysteriously increase despite “level premium” promise

Red Flag: Any company that won’t provide a clear, written quote before you apply.

3. Aggressive Sales Tactics

- High-pressure phone calls after online quote

- Agents who discourage shopping other companies

- Limited-time offers or false urgency

- Requiring immediate decision

Red Flag: Legitimate companies don’t pressure seniors into instant decisions.

4. Poor Financial Ratings

- A.M. Best rating below B+

- Recent financial troubles or state scrutiny

- History of being unable to pay claims

- Frequent ownership changes

Red Flag: Anything below A- rating from A.M. Best is concerning for long-term policies.

5. Overly Restrictive Policies

- Can’t change beneficiaries easily

- Excessive penalties for policy changes

- No cash value despite whole life claims

- Complicated cancellation process

Red Flag: Your policy should be flexible, not lock you into difficult terms.

6. Unrealistic Coverage Claims

- Promising $100,000+ coverage with no health questions

- Claiming “no waiting period” for guaranteed issue (impossible)

- Guaranteeing acceptance but then finding reasons to decline

- Marketing terminology that misleads

Red Flag: If it sounds too good to be true for seniors with health issues, it probably is.

How to Apply: Getting the Best Rate

Once you’ve identified the best life insurance companies for seniors for your situation, follow this process to ensure approval at the best possible rate:

Step 1: Get Multiple Quotes (5+ Companies)

Why: Rates vary 30-50% between companies for identical coverage.

How:

- Use comparison websites for initial quotes

- Call companies directly for accurate pricing

- Work with independent agents who represent multiple insurers

- Don’t rely on just one quote

Time Investment: 2-3 hours gathering quotes saves hundreds annually.

Step 2: Gather Your Information

What You’ll Need:

- Current medications and dosages

- Recent blood pressure readings

- A1C levels if diabetic

- Dates of any hospitalizations (past 2 years)

- Height and weight

- Smoking history (last 2 years minimum)

- Beneficiary information (name, DOB, relationship, SSN)

Why: Having this ready speeds approval and prevents mistakes.

Step 3: Choose Simplified vs Guaranteed Issue

Choose Simplified Issue If:

- Your health conditions are well-managed

- You haven’t been hospitalized recently

- You’re not on oxygen or in hospice

- You can answer health questions honestly

- You want lower premiums (30-50% cheaper)

Choose Guaranteed Issue If:

- You have serious health conditions

- You’ve been declined before

- You’re on oxygen or have severe COPD

- You’re a recent cancer patient

- You want instant approval without questions

Step 4: Complete Application Honestly

Critical: Answer all health questions truthfully.

Why: Insurance companies review medical records before paying claims. Any dishonesty can void your policy—meaning your family gets nothing.

How:

- Don’t minimize health conditions

- Include all medications

- Report all hospitalizations

- Disclose any pending tests or procedures

- When in doubt, disclose it

Step 5: Understand Waiting Periods

Guaranteed Issue Waiting Periods:

- Years 1-2: Death from natural causes returns premiums paid plus 10% interest

- Years 1-2: Accidental death pays full benefit immediately

- Year 3+: Full coverage for any cause of death

Simplified Issue Waiting Periods:

- Usually no waiting period

- Full coverage from day one

- Some policies have 30-day waiting for natural causes

Plan Ahead: If possible, apply while healthy enough for simplified issue to avoid waiting periods.

Step 6: Review Policy Before Accepting

Check These Details:

- Premium amount matches quote

- Coverage amount is correct

- Beneficiary names spelled correctly

- Beneficiary relationships accurate

- Your personal information is right

- Policy type (term vs whole life, guaranteed vs simplified)

Free Look Period: You have 30 days to cancel and get full refund if anything is wrong.

Step 7: Pay First Premium Promptly

Important: Coverage doesn’t start until first premium is paid.

Payment Options:

- Monthly bank draft (most common)

- Quarterly or annual payment (sometimes 5-10% discount)

- Online payment portal

- Phone payment

Set Up Auto-Pay: Ensures you never miss a payment and lose coverage.

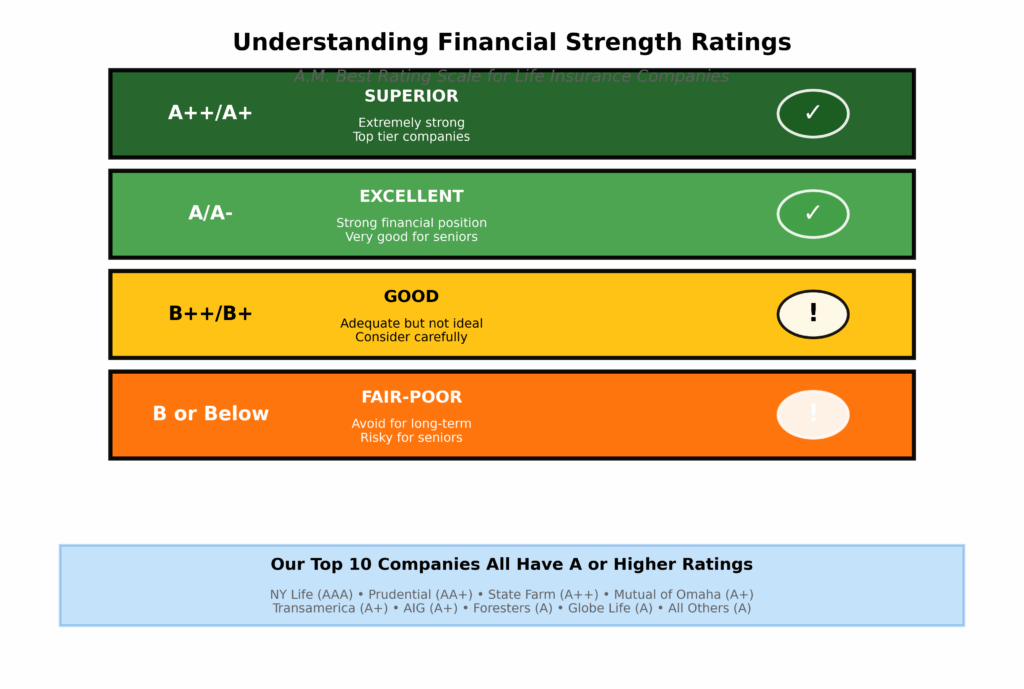

Financial Strength Ratings Explained

When evaluating the best senior life insurance companies, financial strength ratings are crucial. Here’s what the ratings mean:

A.M. Best Ratings (Most Important):

A++ and A+ (Superior):

- Extremely strong financial position

- Excellent ability to pay claims

- These are your top-tier companies

- Examples: New York Life, Prudential, Northwestern Mutual

A and A- (Excellent):

- Strong financial position

- Very good ability to pay claims

- Perfectly acceptable for life insurance

- Examples: Mutual of Omaha, Foresters, AIG

B++ and B+ (Good):

- Good financial position

- Adequate ability to pay claims

- Acceptable but not ideal for long-term policies

- Consider only if significantly cheaper

B and Below (Fair to Poor):

- Vulnerable financial position

- Questions about long-term claim payment

- Avoid for life insurance if possible

- Higher risk your family won’t get paid

Why It Matters:

If you buy at age 65 and live to 85, your insurer must stay financially stable for 20 years. An A-rated or higher company provides confidence they’ll be around to pay your beneficiaries.

Current Ratings of Top Senior Insurers (2025):

- New York Life: A++ (highest rating)

- Prudential: AA+ (excellent)

- Mutual of Omaha: A+ (superior)

- State Farm: A++ (highest rating)

- Foresters Financial: A (excellent)

- AIG: A+ (superior)

- Transamerica: A+ (superior)

- Globe Life: A (excellent)

- Gerber Life: A (excellent)

- Colonial Penn: A (excellent)

The Standard: Look for A- or higher. Anything less introduces unnecessary risk for a product you’re buying for your family’s future security.

Frequently Asked Questions

What is the best life insurance company for seniors over 70?

The best life insurance companies for seniors over 70 are Mutual of Omaha, Foresters Financial, and Globe Life. These companies specialize in senior coverage, offer both guaranteed issue and simplified issue options, accept applicants up to age 85, and provide competitive rates for older ages.

Mutual of Omaha ranks #1 overall because they combine excellent acceptance rates, fair pricing, strong financial strength (A+ rating), and 115+ years in business. For seniors over 70 with health conditions, Foresters Financial offers guaranteed acceptance with no health questions.

For seniors over 70 in good health, AARP/New York Life provides the best rates through simplified issue. Rates at age 70 for $15,000 coverage range from $110-$155/month for females and $128-$198/month for males depending on company and policy type.

The key is choosing between guaranteed issue (accepts everyone but has 2-year waiting period) versus simplified issue (health questions but immediate coverage and lower rates).

Which life insurance company has the lowest rates for seniors?

Globe Life typically offers the lowest rates for seniors across most age groups, followed closely by Mutual of Omaha. For example, a 70-year-old female can get $15,000 coverage for approximately $110/month with Globe Life versus $128-$155/month with other major carriers—a savings of $216-$540 annually.

However, “lowest rate” isn’t always “best value” because you must also consider financial strength, customer service, and claims payment reliability.

Globe Life maintains an A rating from A.M. Best (good but not exceptional) and has mixed customer service reviews. Mutual of Omaha charges slightly more ($118/month for the same 70-year-old female) but offers superior customer service, A+ financial rating, and excellent claims payment record.

For seniors seeking absolute lowest premium, Globe Life wins. For seniors wanting best overall value (price + service + reliability), Mutual of Omaha edges ahead.

Always compare at least 5 companies because rates vary significantly—the difference between most and least expensive can be $50-100/month at older ages.

Can seniors over 80 get life insurance?

Yes, seniors over 80 can absolutely get life insurance through guaranteed issue policies offered by most major senior life insurance companies.

Mutual of Omaha, Foresters Financial, Globe Life, Colonial Penn, and Gerber Life all accept applicants up to age 85. Some companies even accept up to age 89.

Guaranteed issue policies require no medical exam and no health questions, making them perfect for seniors over 80 who typically have health conditions.

The coverage amounts range from $5,000 to $50,000, with most policies offering $15,000-$25,000. Monthly premiums at age 80 for $15,000 coverage typically run $228-$298 for males and $165-$245 for females.

These policies include a 2-3 year waiting period where natural death returns premiums paid plus interest, while accidental death pays full benefit immediately.

After the waiting period, full coverage applies for any cause of death. Seniors over 80 should not delay applying because fewe

Is AARP life insurance a good deal for seniors?

AARP life insurance (underwritten by New York Life) is an excellent deal for AARP members in relatively good health who can answer health questions.

The program offers group rates that are typically 10-20% lower than individual policies, backed by New York Life’s AAA financial strength rating (highest possible).

Coverage amounts up to $100,000 are available with simplified issue (no medical exam, just health questions), and the application process is straightforward.

However, AARP life insurance is NOT guaranteed issue—you must answer health questions about hospitalizations, medications, and conditions, and can be declined if your health is poor.

For seniors with serious health conditions (oxygen use, recent cancer, severe COPD), guaranteed issue policies from Mutual of Omaha or Foresters are better because they accept everyone.

AARP requires membership ($16/year) which is a minor cost considering the premium savings. Rates are very competitive: a 70-year-old female might pay $195/month for $50,000 versus $225-250/month elsewhere.

Best for: AARP members under age 80 in decent health who can qualify for simplified issue and want larger coverage amounts.

What questions do simplified issue policies ask?

Simplified issue life insurance policies typically ask 5-15 health questions that screen for serious conditions and recent hospitalizations.

Common questions include: (1) Have you been hospitalized in the past 2 years? (2) Do you currently use oxygen? (3) Have you been diagnosed with cancer in the past 5-10 years? (4) Do you have heart disease or have you had a heart attack or stroke? (5) Do you have kidney disease or kidney failure? (6) Have you been diagnosed with AIDS or HIV? (7) Are you currently receiving hospice or nursing home care? (8) Do you take medication for diabetes, and if so, what’s your A1C level? (9) What is your current height and weight? (10) Have you used tobacco in the past 12-24 months?

These questions vary by company and policy, but generally focus on major health conditions and recent medical events. You must answer honestly because insurance companies verify information through the Medical Information Bureau (MIB) and can review medical records before paying claims.

If you can answer these questions favorably (no recent hospitalizations, no oxygen, no terminal illness), simplified issue offers lower rates than guaranteed issue and no waiting periods. If you must answer “yes” to multiple questions, guaranteed issue is your better option

How long does it take to get approved for senior life insurance?

Approval time depends on policy type. Guaranteed issue policies offer instant approval—you can be approved and covered within 5-10 minutes by completing an online application or phone call.

No underwriting, no waiting for approval, no medical review. Your coverage starts immediately upon first premium payment (though the 2-year waiting period applies for natural death).

Simplified issue policies typically take 24-48 hours for approval because the insurance company reviews your health questionnaire answers and may check the Medical Information Bureau (MIB) database.

Some simplified issue applications receive instant preliminary approval with final confirmation within 24 hours. Traditional fully underwritten policies (less common for seniors) can take 4-8 weeks because they require medical exams, lab work, and complete medical record review.

For most seniors purchasing final expense or burial insurance, you should expect approval within 48 hours for simplified issue or instant for guaranteed issue.

The fastest companies include Foresters Financial (instant guaranteed issue approval online), Mutual of Omaha (24-hour simplified issue approval), and Gerber Life (same-day approval for most applicants).

What’s the difference between term and whole life for seniors?

Term life insurance covers you for a specific period (10, 20, or 30 years) and expires worthless if you outlive the term, while whole life insurance provides permanent coverage for your entire life and builds cash value.

For most seniors, whole life is the better choice because you need coverage that lasts your entire lifetime—you can’t outlive it. Term life made sense when you were younger and only needed coverage while children were dependent or a mortgage needed protection, but seniors typically need permanent coverage for funeral expenses and final bills.

Whole life premiums are higher than term (sometimes 2-3X more), but term life for seniors over 70 becomes prohibitively expensive and often expires before you pass away, leaving your family with nothing.

Additionally, most senior life insurance companies primarily offer whole life policies (sometimes called “final expense” or “burial insurance”) because they understand senior needs. If you’re a younger senior (50-65) and only need coverage for 10-15 years until a specific debt is paid, term life might work. But for most seniors 70+, whole life is the appropriate product because it guarantees your family will receive the death benefit whenever you pass away.

Can I get life insurance if I have diabetes or heart disease?

Yes, you can absolutely get life insurance with diabetes or heart disease from the best life insurance companies for seniors. You have two main options:

(1) Simplified issue policies from companies like AIG, Mutual of Omaha, or Transamerica that specialize in managed health conditions—these ask health questions but accept well-controlled diabetes and heart disease, offer competitive rates, and provide immediate coverage with no waiting period;

or (2) Guaranteed issue policies from Foresters, Mutual of Omaha, or Globe Life that accept anyone regardless of health conditions with no questions asked, though premiums are 30-50% higher and include a 2-year waiting period.

For simplified issue approval with diabetes, insurers look for A1C levels below 8-9, stable medication regimen, no recent hospitalizations, and no other major complications.

For heart disease, they want stable condition with medication, no heart attacks or strokes in past 2-5 years, and cleared by cardiologist. Many seniors with diabetes and controlled high blood pressure successfully get simplified issue coverage.

If your conditions are more severe (A1C over 9, recent cardiac events, multiple hospitalizations), guaranteed issue is your better option because you can’t be declined.

How much does life insurance cost for a 75-year-old?

Life insurance costs for a 75-year-old vary significantly based on coverage amount, policy type (guaranteed vs simplified issue), gender, and smoking status.

For guaranteed issue policies (no health questions), a 75-year-old can expect these approximate monthly rates for $15,000 coverage: female non-smoker $135-$168/month, male non-smoker $178-$215/month, female smoker $245-$305/month, and male smoker $325-$390/month.

For simplified issue (health questions but better rates), a healthy 75-year-old pays approximately: female $95-$125/month and male $140-$180/month for the same $15,000 coverage. For $25,000 coverage, multiply these rates by approximately 1.6X. For $10,000 coverage, multiply by 0.7X.

The difference between most and least expensive companies can be $30-50/month, or $360-$600 annually, making comparison shopping essential.

The least expensive carriers for 75-year-olds are typically Mutual of Omaha ($142/month female, $188/month male), Globe Life ($135/month female, $178/month male), and Gerber Life ($98/month female, $125/month male for $10K).

These rates are level premiums that never increase, but waiting until age 76 will cost 8-12% more, so applying sooner saves money.

If you miss a premium payment on senior life insurance, most companies provide a 30-31 day grace period to pay without losing coverage or paying penalties.

If you pay within this grace period, your policy remains in force as if no payment was missed. If you don’t pay within the grace period, your policy lapses (cancels), and you lose all coverage.

At that point, you must reapply for new coverage, which means higher premiums due to being older and potentially being declined if your health has worsened. Some companies send multiple reminder notices before cancellation, but you cannot rely on this.

Many top life insurance companies for seniors offer reinstatement provisions where you can reactivate a lapsed policy within 1-2 years by paying all back premiums plus interest and possibly answering health questions, but this isn’t guaranteed.

The best protection is setting up automatic bank draft payments to ensure you never miss a payment. If you’re struggling financially, contact your insurance company before missing payments—some offer options like reduced paid-up insurance (lower death benefit but no more premiums required) or premium payment assistance programs.

Never let a policy lapse if avoidable because replacing it will cost significantly more at your new older age.

Can I change my beneficiary anytime?

Yes, you can change your life insurance beneficiary at any time for any reason, and you don’t need permission from your current beneficiary (unless you’ve designated an “irrevocable beneficiary,” which is rare).

Most senior life insurance companies make beneficiary changes simple: you can submit a change form online, call customer service, mail a form, or work through your agent. The process typically takes 1-2 business days to process.

You should review your beneficiaries annually and update them after major life events like marriages, divorces, births, deaths, or family relationship changes.

Common reasons for beneficiary changes include: death of original beneficiary, divorce (removing ex-spouse), birth of grandchildren, change of mind about who should receive proceeds, or adding/removing family members.

You can name primary beneficiaries (first in line) and contingent beneficiaries (backup if primary is deceased). You can also split proceeds among multiple beneficiaries (50% to spouse, 25% to each of two children, for example).

Always keep your beneficiary information current because outdated designations can cause family disputes, delays in payment, or money going to unintended recipients.

If you don’t name a beneficiary, proceeds go to your estate and must go through probate, which delays payment and adds costs for your family.

Are life insurance proceeds taxable?

No, life insurance death benefit proceeds are NOT taxable as income to beneficiaries in almost all cases. Your beneficiaries receive the full death benefit tax-free.

For example, if you have a $25,000 policy, your beneficiaries receive the complete $25,000 with no federal income tax, no state income tax, and no inheritance tax in most states.

This tax-free treatment is one of the major advantages of life insurance and applies regardless of policy size. However, there are a few rare exceptions: (1) If your estate is over $13.61 million (2024 threshold), the death benefit may be subject to estate tax, though this affects less than 0.1% of Americans; (2) If the policy earns interest before being paid out (rare with prompt claims), the interest portion may be taxable; (3) If you transfer policy ownership within 3 years of death, it may be included in your estate for tax purposes.

For the vast majority of seniors purchasing final expense insurance, the death benefit is completely tax-free to beneficiaries, and they receive every dollar to use for funeral expenses, bills, or any purpose they choose. This is in contrast to inherited IRAs, 401(k)s, and other assets which may trigger significant tax bills for beneficiaries.

Taking Action: Your Next Steps

Now that you know the best life insurance companies for seniors, here’s how to move forward and secure your coverage:

This Week:

Day 1-2: Compare Companies

- Review the top 10 companies above

- Identify 3-5 that fit your situation

- Check their websites for initial information

- Read recent customer reviews

Day 3-4: Get Quotes

- Contact all 3-5 companies for quotes

- Request quotes for both simplified and guaranteed issue

- Ask about discounts (annual payment, non-smoker, etc.)

- Get everything in writing

Day 5: Compare Quotes

- Create simple spreadsheet comparing:

- Monthly premium

- Coverage amount

- Policy type

- Waiting period

- Financial strength rating

- Customer service reviews

Day 6-7: Make Decision

- Choose top 2 companies

- Verify they’re licensed in your state

- Confirm financial ratings haven’t changed

- Read policy details carefully

This Month:

Week 2: Complete Application

- Gather all required information

- Answer all questions honestly

- Review application before submitting

- Keep copy of everything

Week 2-3: Receive Approval

- Wait for underwriting decision (24-48 hours typical)

- Review policy documents when received

- Verify all information is correct

- Ask questions about anything unclear

Week 3-4: Activate Policy

- Pay first premium

- Set up automatic payments

- Inform beneficiaries about policy

- Store policy documents safely

Ongoing:

Every Year:

- Review beneficiary designations

- Verify coverage still meets needs

- Check company financial ratings

- Ensure premiums are still affordable

After Major Life Changes:

- Update beneficiaries if needed

- Consider coverage increases for younger seniors

- Review if health improves (may qualify for better rates)

Every 3-5 Years:

- Shop rates again (may find better deal)

- Consider additional coverage if needed

- Verify company is still highly rated

Conclusion: Choosing Your Best Life Insurance Company

The best life insurance companies for seniors share common traits: they specialize in senior coverage, accept common health conditions, offer competitive rates for older ages, maintain strong financial ratings, and provide excellent customer service. But the “best” company for you depends on your specific age, health status, coverage needs, and budget.

For most seniors, Mutual of Omaha represents the best overall choice—combining competitive rates, excellent approval rates, strong financial strength (A+ rating), 115+ years in business, and both simplified and guaranteed issue options. They’re the safe, reliable choice that rarely disappoints.

For AARP members in good health, AARP/New York Life offers the best rates for larger coverage amounts with the security of New York Life’s AAA rating backing the policies.

For seniors with serious health conditions, Foresters Financial provides guaranteed acceptance with instant approval and straightforward online application—no one gets declined.

For budget-conscious seniors, Globe Life consistently offers the lowest premiums, though with slightly less stellar customer service than premium competitors.

The key is getting quotes from multiple companies in the top life insurance companies for seniors list above, comparing identical coverage amounts, and choosing based on the combination of price, company strength, and your specific health situation.

Don’t procrastinate—every year you wait means higher premiums and potentially worse health that limits your options. The best time to buy life insurance was yesterday. The second-best time is today.

Your family will thank you for taking the time to secure affordable, reliable coverage from a company that will be there when they need it most.

Disclaimer: This article provides general information about life insurance companies and should not be considered insurance, financial, or legal advice. Insurance company ratings, products, rates, and availability change frequently and vary by state, age, health status, and individual circumstances. Premium rates quoted are approximate ranges for illustration purposes and may not reflect actual rates available to you. Always verify current information directly with insurance companies, review complete policy documents before purchasing, and compare multiple quotes. Company rankings and recommendations are based on general factors and may not reflect your specific needs or situation. Consult with licensed insurance professionals regarding your particular circumstances. This guide is not affiliated with or endorsed by any insurance company mentioned. Information is current as of publication date but insurance products and company ratings change over time.