Transamerica Final Expense Insurance Review 2025: Complete Guide for Seniors

Planning for end-of-life expenses isn’t the most comfortable conversation, but it’s one of the most thoughtful gifts you can give your loved ones. If you’re exploring burial insurance options, you’ve probably come across Transamerica’s final expense products. But is Transamerica final expense insurance the right choice for you?

In this comprehensive review, we’ll walk you through everything you need to know about Transamerica’s burial insurance offerings. Whether you’re in your 50s and planning ahead or in your 80s and looking for coverage that accepts health conditions, this guide will help you make an informed decision.

Let’s dive into how Transamerica’s final expense insurance works, what it costs, and whether it’s worth your consideration in 2025.

What is Transamerica Final Expense Insurance?

Transamerica final expense insurance is a specialized type of whole life insurance policy designed specifically to cover the costs associated with your passing. Sometimes called burial insurance or funeral insurance, this coverage ensures your family won’t face financial burdens when dealing with your final arrangements.

Understanding Final Expense Coverage

Think of final expense insurance as a safety net for your loved ones. When you pass away, your family faces immediate expenses: funeral services, burial or cremation costs, outstanding medical bills, and sometimes unexpected debts. These expenses can easily reach $10,000 to $15,000 or more, creating financial stress during an already difficult time.

Transamerica’s final expense insurance provides a death benefit that your beneficiaries can use for any purpose. The money is paid directly to them (or to your funeral home if you prefer) completely tax-free, with no restrictions on how it’s spent. Whether they need to cover funeral costs, pay off medical bills, settle credit card debts, or simply have financial breathing room, the choice is theirs.

Key Features That Set It Apart

What makes Transamerica’s offering particularly appealing for seniors is its accessibility. Unlike traditional life insurance that often requires medical exams and extensive health screenings, Transamerica final expense insurance uses a simplified application process. You’ll answer health questions and Transamerica reviews your prescription history to understand your overall health profile, but there’s no need to schedule a physical exam or undergo blood tests.

This whole life policy also builds cash value over time and provides permanent coverage that lasts your entire lifetime, as long as you keep up with your premium payments.

How Does Transamerica Final Expense Insurance Work?

Understanding how this insurance works is crucial to determining if it fits your needs. Let’s break down the process from application to payout.

The Application Process: Simple and Straightforward

Applying for Transamerica burial insurance is designed to be as hassle-free as possible. Here’s what you can expect:

Step 1: Answer Health Questions

You’ll complete an application that asks about your current health conditions, medical history, and lifestyle factors. While the application is more comprehensive than some competitors, this thoroughness often works in your favor by allowing Transamerica to accurately assess your situation.

Step 2: Prescription History Review

Transamerica examines your prescription medication history. This gives them a clear, objective picture of your health without requiring you to visit a doctor’s office. Your prescription records don’t lie and often reveal conditions that applicants might forget to mention.

Step 3: Quick Approval Decision

Most applicants receive a decision within 15 minutes or less. This rapid turnaround means you can have peace of mind quickly, without weeks of waiting and wondering.

Step 4: No Medical Exam Required

One of the biggest advantages for seniors is that Transamerica doesn’t require you to undergo a medical examination. No needles, no doctor visits, no physical tests. Just honest answers to health questions.

Understanding Your Health Rating

After reviewing your application, Transamerica assigns you to one of three health rating categories. Your rating determines your premium cost and whether there’s a waiting period before full coverage begins.

Preferred Plan: Best Rates, Immediate Coverage

The preferred plan is Transamerica’s least expensive option and comes with immediate full coverage from day one. To qualify for preferred rates, you’ll need to answer “no” to all the health-related questions on the application. This plan is ideal if you’re relatively healthy and don’t have significant medical conditions.

With the preferred plan, if something happens to you the day after your policy goes into effect, your beneficiaries receive the full death benefit. There’s no waiting, no reduced payout, just complete protection.

Standard Plan: Competitive Rates, Still No Waiting Period

The standard plan costs more than the preferred option but still provides immediate full coverage with no waiting period. You’ll be offered this rating if you have certain health conditions mentioned in the application but nothing considered high-risk.

Many seniors with common health issues like controlled diabetes, high blood pressure, or past heart problems (more than a year ago) can qualify for the standard plan. The slightly higher premium is a small price to pay for the security of knowing your family is fully protected from day one.

Graded Plan: Coverage for High-Risk Conditions

The graded plan is Transamerica’s most expensive option and includes a two-year waiting period. This plan is typically offered to applicants with very serious health conditions or those currently taking certain medications, particularly antipsychotics.

Here’s how the graded benefit works: If you pass away during the first two years and it’s not from an accident, your beneficiaries receive 110% of the premiums you’ve paid, rather than the full death benefit. After two years, the full face amount is paid regardless of how you pass away.

If your death is accidental during those first two years, your beneficiaries still receive the full death benefit amount.

When Your Family Receives the Death Benefit

When you pass away, your beneficiaries contact Transamerica to file a claim. The company has streamlined this process to be as compassionate and efficient as possible during a difficult time. Your loved ones receive the death benefit payment tax-free, typically within days, allowing them to handle immediate expenses without financial strain.

The flexibility of how the money can be used is remarkable. Your beneficiaries can apply it toward:

- Funeral service costs

- Burial plot and headstone

- Cremation expenses

- Outstanding medical bills

- Credit card or loan debts

- Mortgage payments

- Daily living expenses

- Anything else they need

Any money remaining after covering your final expenses stays with your beneficiaries. It’s their money to keep and use as they see fit.

Transamerica Final Expense Coverage Details

Let’s look at the specific details of what Transamerica offers, so you can see exactly what you’re getting.

Coverage Amounts Based on Your Age

Transamerica provides flexible coverage amounts ranging from a minimum of $1,000 up to $50,000, depending on your age and health rating.

Maximum Coverage by Age:

- Ages 0-55: Up to $50,000 (Preferred/Standard) or $25,000 (Graded)

- Ages 56-65: Up to $40,000 (Preferred/Standard) or $25,000 (Graded)

- Ages 66-75: Up to $30,000 (Preferred/Standard) or $25,000 (Graded)

- Ages 76-85: Up to $25,000 (All plans)

This tiered structure recognizes that younger applicants may want more coverage for a variety of financial obligations, while older applicants typically seek amounts specifically designed to cover funeral and burial expenses.

Eligibility and Age Requirements

Transamerica accepts applications from individuals as young as 45 and up to age 85. This wide age range makes it accessible whether you’re planning early or seeking coverage later in life.

The fact that you can apply up to age 85 is particularly significant. Many insurance companies cut off applications at age 80 or even earlier, leaving the oldest seniors with limited options.

Policy Duration and Premium Guarantees

This is true whole life insurance, meaning your coverage lasts your entire lifetime. As long as you pay your premiums on time, your policy remains in force whether you live to 90, 100, or beyond.

Your premiums are also guaranteed to never increase. The amount you pay when you start the policy is the amount you’ll pay for the rest of your life. This predictability is invaluable for seniors on fixed incomes who need to budget carefully.

Cash Value Accumulation

Like all whole life policies, Transamerica final expense insurance builds cash value over time. A portion of each premium payment goes into a cash account that grows slowly but steadily.

You can borrow against this cash value if needed for emergencies, major purchases, or other financial needs. The loan carries interest, and any outstanding loan balance is deducted from your death benefit, but you’re not required to repay it during your lifetime.

This feature provides a safety net and additional financial flexibility, though most people purchase final expense insurance primarily for the death benefit protection.

Built-In and Optional Riders

Included at No Extra Cost:

Every policy includes a terminal illness rider. If you’re diagnosed with a terminal condition and given a limited time to live, you can access a portion of your death benefit early to cover medical expenses or improve your quality of life in your final months.

Optional Add-Ons:

You can enhance your coverage with an accidental death rider, which doubles your death benefit if you pass away from an accident. For example, if you have a $20,000 policy and die in a car accident, your beneficiaries would receive $40,000.

How Much Does Transamerica Burial Insurance Cost?

Cost is naturally one of your primary considerations when shopping for burial insurance. Let’s break down what you can expect to pay for Transamerica final expense insurance.

Factors That Affect Your Premium

Several factors influence your final premium:

- Your Age: Older applicants pay higher premiums because they’re statistically closer to filing a claim

- Gender: Women typically pay less than men at the same age because they have longer life expectancies

- Health Rating: Preferred rates are lowest, standard rates are moderate, and graded rates are highest

- Coverage Amount: More coverage means higher premiums

- Tobacco Use: Smokers pay more than non-smokers

- State of Residence: Insurance regulations and costs vary by state

Sample Monthly Premium Rates

To give you a concrete idea of costs, here are sample monthly premiums for a $10,000 death benefit policy across different ages and health ratings. These rates are current for 2025.

Transamerica Final Expense Monthly Premiums (for $10,000 Coverage)

| Age | Preferred Plan (Female) | Preferred Plan (Male) | Standard Plan (Female) | Standard Plan (Male) | Graded Plan (Female) | Graded Plan (Male) |

|---|---|---|---|---|---|---|

| 50 | $24.23 | $30.55 | $27.67 | $34.66 | $62.75 | $75.79 |

| 55 | $27.60 | $35.76 | $34.12 | $42.37 | $72.63 | $91.43 |

| 60 | $32.71 | $43.49 | $39.42 | $51.11 | $83.12 | $106.90 |

| 65 | $40.77 | $53.97 | $49.35 | $66.43 | $101.79 | $136.46 |

| 70 | $52.88 | $69.78 | $69.68 | $101.90 | $125.55 | $177.08 |

| 75 | $70.94 | $97.30 | $93.74 | $135.00 | $155.88 | $231.67 |

| 80 | $101.26 | $136.34 | $135.32 | $190.34 | $218.84 | $334.63 |

| 85 | $158.59 | $213.94 | $202.25 | $280.60 | N/A | N/A |

Note: These are sample rates for non-tobacco users. Actual rates may vary based on your specific health profile, tobacco use, and state of residence.

Understanding the Value

When you look at these numbers, consider what you’re getting for your monthly investment. For example, a 65-year-old woman paying $40.77 per month receives $10,000 in coverage. Over 10 years, she’ll pay about $4,892 in premiums. But from day one, her beneficiaries are protected with the full $10,000 benefit.

If you’re comparing costs with other companies, make sure you’re looking at similar coverage amounts and health ratings. Some companies advertise low rates but may have more restrictive underwriting or waiting periods that reduce their value.

Health Conditions Transamerica Accepts Without Waiting Periods

One of the most impressive aspects of Transamerica final expense insurance is their lenient underwriting for common senior health conditions. Many conditions that would disqualify you from traditional life insurance or force you into a graded plan elsewhere can still qualify you for immediate coverage with Transamerica’s preferred or standard plans.

Conditions Approved for Immediate Full Coverage

If you have any of these conditions but they’re controlled or meet specific criteria, you may still qualify for a plan without a waiting period:

Heart and Circulatory Conditions:

- Atrial fibrillation (AFib)

- Angina (chest pains)

- Aneurysm (if surgically repaired)

- Blood clots (past history)

- Blood thinners (current use)

- Circulatory surgery (more than 1 year ago)

- Heart attack (more than 1 year ago)

- Heart surgery (more than 1 year ago)

- High blood pressure (controlled)

- High cholesterol

- Pacemaker (installed more than 1 year ago)

- Stroke or TIA (more than 1 year ago)

- Heart Disease

Respiratory Conditions:

- Asthma

- Chronic bronchitis

- COPD (chronic obstructive pulmonary disease)

- Sleep apnea

Metabolic and Endocrine Disorders:

- Type 2 diabetes (controlled)

- Grave’s disease

Neurological Conditions:

- Epilepsy

- Multiple sclerosis

- Parkinson’s disease

- Seizures

Mental Health Conditions:

- Bipolar disorder

- Depression

- Schizophrenia

Autoimmune and Inflammatory Conditions:

- Arthritis

- Crohn’s disease

- Fibromyalgia

- Lupus

- Scleroderma

Other Conditions:

- Blindness

- Cancer (more than 4 years in remission)

- Diverticulitis

- Hepatitis

- Kidney disease (not on dialysis)

- Squamous or basal cell skin cancer

- Tumors (benign or past history)

What This Means for You

This extensive list demonstrates that Transamerica understands the reality of aging. Most people over 60 have at least one or two health conditions on this list. Rather than automatically denying coverage or imposing waiting periods, Transamerica evaluates each application individually.

For example, if you had a heart attack 18 months ago but have recovered well and are following your doctor’s treatment plan, you can likely qualify for standard plan coverage with no waiting period. Your beneficiaries would be fully protected from day one.

This approach makes Transamerica an excellent option for seniors who have been turned down by other insurance companies or who were only offered expensive graded policies elsewhere.

Conditions That May Result in a Graded Plan

While Transamerica is quite lenient, certain conditions typically result in a graded plan offer:

- Current cancer diagnosis or treatment

- Cancer less than 4 years in remission

- Kidney disease requiring dialysis

- Heart attack, heart surgery, or stroke within the past year

- Use of antipsychotic medications (regardless of the reason)

- Certain terminal or degenerative conditions

If you’re offered the graded plan, carefully consider whether the higher premiums and two-year waiting period fit your situation and budget.

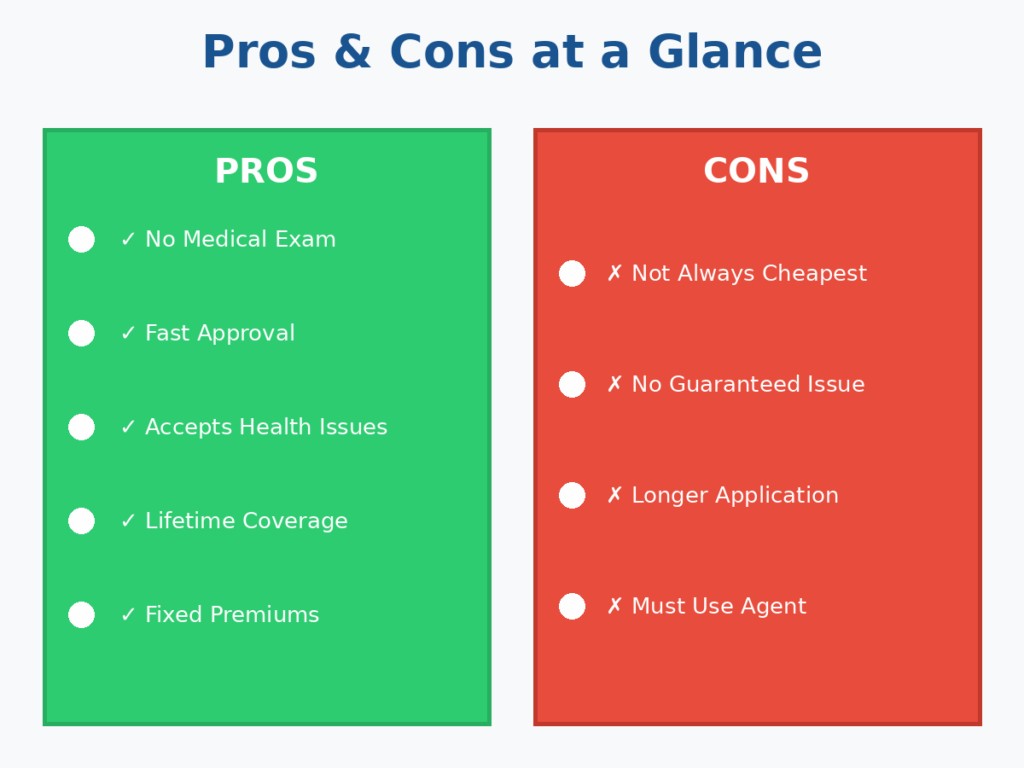

The Pros of Transamerica Final Expense Insurance

Let’s examine the key advantages that make Transamerica burial insurance worth considering for many seniors.

1. No Waiting Period for Qualified Applicants

If you qualify for the preferred or standard plan, you receive immediate full coverage with no waiting period. This is a significant advantage over guaranteed issue policies that make everyone wait two to three years before full benefits kick in.

Immediate coverage means peace of mind from day one. You don’t have to worry about what happens if the unexpected occurs during a waiting period.

2. No Medical Exam Required

The thought of scheduling a medical exam can be stressful, especially if you have mobility issues or anxiety about medical procedures. Transamerica eliminates this hurdle entirely. Answer health questions honestly on your application, and they’ll handle the rest by reviewing your prescription history.

This simplified underwriting saves you time, eliminates stress, and speeds up the approval process significantly.

3. Remarkably Fast Approval Times

Most applicants receive an approval decision within 15 minutes or less. Compare this to traditional life insurance policies that can take weeks or even months for approval, and you’ll appreciate the efficiency.

Fast approval means you can move forward with your plans quickly and stop worrying about whether you’ll be covered.

4. Flexible Payment Options

Transamerica understands that many seniors receive income through Social Security, so they offer convenient payment methods including Direct Express credit cards. You can set up automatic payments so you never have to worry about missing a premium and losing your coverage.

Monthly payment options also make the premiums more manageable on a fixed income compared to annual lump-sum payments.

5. Competitive Rates for Seniors Over 70

When comparing rates across multiple insurance companies, Transamerica consistently offers competitive premiums, particularly for seniors in their 70s and 80s. Their pricing structure recognizes that you’re looking for burial insurance specifically, not massive death benefits.

The combination of reasonable rates and lenient underwriting creates real value.

6. Nationwide Availability

Transamerica final expense insurance is available in all 50 states plus Washington D.C. Whether you live in rural Montana or downtown Miami, you can access their coverage.

This nationwide availability also means you don’t lose your coverage if you relocate to a different state during retirement.

7. True Lifetime Coverage with Locked-In Premiums

Your policy will never expire as long as you pay your premiums. You don’t have to worry about your coverage ending at age 90 or 100 like some term policies.

Additionally, your premiums are guaranteed never to increase. The rate you lock in at application is your rate forever, providing budgeting certainty that’s crucial when living on a fixed retirement income.

8. Lenient Health Underwriting

As we discussed earlier, Transamerica accepts numerous health conditions that would disqualify you elsewhere. Conditions like COPD, controlled diabetes, Parkinson’s disease, kidney disease (not requiring dialysis), and past heart issues (more than a year ago) can still qualify you for immediate coverage.

This inclusive approach opens doors for seniors who thought they couldn’t get life insurance.

9. High Coverage Amounts for Younger Applicants

If you’re under 55 and planning ahead, you can secure up to $50,000 in coverage. This higher amount gives you flexibility to ensure all your final expenses are covered with room to spare for your beneficiaries.

Even applicants in their 60s can access $30,000 to $40,000 in coverage, which is more than adequate for comprehensive final expense protection.

The Cons of Transamerica Final Expense Insurance

No insurance product is perfect for everyone. Here are some potential drawbacks to consider when evaluating Transamerica burial insurance.

1. Not Always the Cheapest Option

While Transamerica offers competitive rates in many age brackets and health situations, they’re not always the absolute cheapest option available. Depending on your specific age, health profile, and state of residence, you might find lower premiums with other carriers.

This is why comparison shopping is so important. Get quotes from multiple companies to ensure you’re getting the best value for your particular situation.

2. Expensive Graded Plan Rates

If you’re only eligible for Transamerica’s graded plan, the premiums can be significantly higher than similar offerings from competitors who specialize in guaranteed issue or graded benefit policies.

For example, looking at the rate table above, an 80-year-old male on the graded plan would pay $334.63 monthly for just $10,000 in coverage. That’s $4,015.56 per year, and remember there’s a two-year waiting period before full benefits apply.

If you’re only being offered the graded plan, definitely shop around before committing.

3. Antipsychotic Medications Trigger Graded Rating

One of the more frustrating aspects of Transamerica’s underwriting is their policy regarding antipsychotic medications. If you’re taking any medication classified as an antipsychotic, regardless of why it was prescribed, you’ll automatically be placed in the graded plan.

The issue is that doctors sometimes prescribe these medications “off-label” for conditions like insomnia, anxiety, or depression management, not for psychotic disorders. Even if you’re taking a low dose for sleep and are otherwise healthy, you’d still face the graded plan’s higher premiums and waiting period.

If this applies to you, ask your doctor if there are alternative medications that could work for your condition, or explore other insurance companies that don’t have this blanket restriction.

4. No Guaranteed Issue Option

Transamerica doesn’t offer a guaranteed acceptance policy. Every applicant must answer health questions and can be declined if their health conditions are too severe.

If you need guaranteed issue coverage because you’ve been declined elsewhere or have extremely serious health conditions, you’ll need to look at companies that specialize in guaranteed acceptance policies, such as SBLI, Mutual of Omaha’s guaranteed acceptance product, or others.

5. Longer Application Process

While approval is fast (typically 15 minutes), the actual application itself is more comprehensive than many competitors. You’ll answer more questions and provide more detailed information about your health history.

Some applicants find this thorough approach tedious, but remember that it exists for good reason. The detailed questions allow Transamerica to more accurately assess your situation, potentially qualifying you for better rates than a company with a shorter, less detailed application.

6. Must Apply Through an Agent

You cannot purchase Transamerica final expense insurance directly from the company online. You must work with an independent insurance agent or agency that’s licensed to sell Transamerica products.

For some seniors who prefer handling everything themselves online, this requirement feels like an inconvenience. However, many people actually appreciate having an agent explain options, answer questions, and help navigate the application process.

Is Transamerica Final Expense Insurance Worth It?

After examining all the features, costs, and pros and cons, the ultimate question remains: Is Transamerica burial insurance a good choice for you?

When Transamerica Is an Excellent Choice

Transamerica final expense insurance is particularly well-suited if you:

Have Common Health Conditions: If you have conditions like COPD, controlled diabetes, Parkinson’s, past heart issues, or kidney disease (not on dialysis), Transamerica’s lenient underwriting may qualify you for immediate coverage when other companies won’t.

Qualify for Preferred or Standard Plans: If you can get approved for either of these plans, you’re getting competitive rates with no waiting period. This combination of immediate coverage and reasonable premiums creates genuine value.

Want Fast Approval: If you need coverage quickly and don’t want to wait weeks for underwriting decisions, Transamerica’s 15-minute approval process is hard to beat.

Are Over 70: Transamerica’s rates for seniors in their 70s and early 80s are particularly competitive compared to industry averages.

Live in Any State: Since Transamerica operates nationwide, you don’t have to worry about limited availability based on where you live.

Value Financial Stability: Transamerica is a financially sound company with strong ratings. You can trust they’ll be around to pay your claim when needed.

When to Consider Other Options

Transamerica might not be your best choice if:

You Only Qualify for the Graded Plan: The graded plan premiums are expensive, and the two-year waiting period significantly limits value. If you’re healthy enough to qualify for a graded plan with Transamerica, you might find better options with companies specializing in this coverage tier, or you might even qualify for standard plans elsewhere.

You’re Taking Antipsychotic Medications: If your only health issue is that you take antipsychotic medication for sleep or anxiety management, shop around. Some companies may not have this blanket restriction and could offer you better rates.

You Need Guaranteed Issue: If you’ve been declined for coverage or have very serious health conditions, you’ll need to look at guaranteed acceptance policies from other carriers.

You Find Better Rates Elsewhere: Always compare quotes. If another highly-rated company offers significantly better premiums for the same coverage, it makes sense to go with them instead.

The Importance of Comparison Shopping

Even though Transamerica offers solid burial insurance products, every senior’s situation is unique. What works perfectly for your neighbor might not be the best fit for you.

Before making a final decision:

- Get Multiple Quotes: Obtain quotes from at least 3-5 different companies to compare rates at your age and health profile

- Compare Coverage Features: Look at waiting periods, coverage amounts available, and built-in benefits

- Check Financial Ratings: Ensure any company you’re considering has strong financial stability ratings

- Read the Fine Print: Understand exclusions, contestability periods, and claim procedures

- Ask Questions: Don’t hesitate to ask agents to clarify anything you don’t understand

Remember, this is a lifetime commitment. Taking time to compare options now ensures you make the best decision for your family’s financial protection.

How Transamerica Compares to Competitors

To give you better context, let’s briefly compare Transamerica to other major players in the final expense insurance market.

Transamerica vs. Mutual of Omaha

Both companies offer competitive rates and similar coverage amounts. Mutual of Omaha also provides multiple plan options including guaranteed issue, which Transamerica doesn’t offer. Overall, their pricing is comparable, with each company offering better rates in different age brackets.

Choose Transamerica if: You have health conditions they accept for standard plan coverage and want fast approval.

Choose Mutual of Omaha if: You need guaranteed issue coverage or prefer working with a company that offers more plan variety.

Transamerica vs. SBLI

SBLI (Savings Bank Life Insurance) often offers lower rates for healthier applicants but has stricter health underwriting. They’re excellent if you’re in good health but less accessible if you have significant health issues.

Choose Transamerica if: You have health conditions that might disqualify you from SBLI or receive better rates from Transamerica.

Choose SBLI if: You’re in good health and qualify for their best rates.

Transamerica vs. Colonial Penn

Colonial Penn is famous for their guaranteed issue product that accepts everyone regardless of health. However, their rates are typically higher than Transamerica’s, and they have waiting periods for all applicants.

Choose Transamerica if: You can qualify for their preferred or standard plans, as you’ll get better rates and immediate coverage.

Choose Colonial Penn if: You need guaranteed acceptance because you’ve been declined elsewhere.

Transamerica vs. AIG (American General)

AIG offers strong products with competitive rates and good health underwriting. Their coverage amounts and terms are similar to Transamerica.

Choose Transamerica if: You prefer their faster application process or get better rates at your specific age.

Choose AIG if: They offer you lower premiums or you prefer their specific policy features.

The key takeaway is that Transamerica holds its own against major competitors but isn’t definitively “better” or “worse” than alternatives. Your best choice depends on your individual circumstances.

Frequently Asked Questions

How long does it take to get approved for Transamerica burial insurance?

Most applicants receive an approval decision within 15 minutes or less after submitting their application. In some cases where additional review is needed, it might take up to 24 hours, but this is uncommon.

Can I apply for Transamerica final expense insurance online?

You cannot apply directly through Transamerica’s website. You must work with a licensed insurance agent or independent agency that sells Transamerica products.

The agent can often handle much of the process electronically, but you’ll go through them rather than directly through Transamerica.

Whole life policies typically include a grace period (usually 30-31 days) during which your coverage remains in force even if you miss a payment.

If you die during the grace period, the death benefit is still paid, minus any premium owed. If the grace period expires without payment, your policy may lapse. Some policies use accumulated cash value to keep the policy in force temporarily.

Can I increase my coverage amount later?

Generally, you cannot simply increase the death benefit on an existing final expense policy. If you want more coverage, you would need to apply for an additional policy. Your premiums would be based on your current age and health at the time of the new application.

Are there any exclusions I should know about?

Common exclusions in the first two years include suicide (in most states, if death is by suicide within the first two policy years, beneficiaries only receive premiums paid back). For graded plans, non-accidental death in the first two years results in only 110% of premiums paid. Always review your specific policy documents for complete exclusion details.

What if I move to another state?

Your coverage continues if you move to another state. Transamerica policies are portable across all 50 states plus D.C. You should update your address with the company, but your coverage and rates remain the same.

Can my beneficiaries receive the death benefit quickly?

Yes, Transamerica processes claims efficiently. Once proper documentation is submitted, beneficiaries typically receive payment within a few days to a week. This speed allows families to handle immediate funeral expenses without financial strain.

What if I’m declined by Transamerica?

If Transamerica declines your application, you have options. Look into guaranteed issue policies from companies like Colonial Penn, Gerber Life, or Mutual of Omaha’s guaranteed acceptance product. These policies accept everyone regardless of health but typically have higher premiums and waiting periods.

Can I name multiple beneficiaries?

Yes, you can name multiple beneficiaries and specify what percentage of the death benefit each person should receive. You can also name contingent (backup) beneficiaries in case your primary beneficiaries predecease you.

Is the death benefit really tax-free?

Yes, life insurance death benefits are generally income tax-free to beneficiaries under federal law. There are rare exceptions involving large estates and estate taxes, but for typical final expense policies in the $10,000-$50,000 range, beneficiaries receive the full amount tax-free.

Our Final Thoughts: Should You Choose Transamerica?

After this comprehensive review, here’s our bottom-line assessment of Transamerica final expense insurance.

The Verdict

If you qualify for Transamerica’s preferred or standard plan, their burial insurance is definitely worth serious consideration. The combination of competitive rates, no waiting period, lenient health underwriting, and fast approval makes it a solid choice for many seniors.

Transamerica has earned its reputation as one of the better final expense insurance providers in the market. They’ve made our list of top funeral insurance companies because they understand what seniors need: affordable protection that’s easy to obtain even when health isn’t perfect.

Remember This Key Principle

While Transamerica is a reputable company with strong products, no single insurance company is the perfect choice for everyone. Each carrier has different pricing structures, health underwriting criteria, and policy features. What represents the best value for your neighbor might not be the best option for you.

Always compare multiple providers before making your final decision. Get quotes from at least 3-5 companies, compare the coverage details, and evaluate what each offers at your specific age and health profile.

The Value Proposition

Overall, Transamerica offers one of the more cost-effective final expense plans in the industry, with pricing comparable to respected competitors like Mutual of Omaha. Their strength lies in helping seniors with various medical conditions still qualify for immediate coverage without breaking the bank.

However, approach their graded plan with caution. The premiums are steep, and the two-year waiting period significantly diminishes value compared to alternatives in the market.

Financial Security You Can Trust

From a financial stability standpoint, Transamerica provides peace of mind. They’re a well-established company with strong ratings from major financial rating agencies. You can feel confident they’ll be around to fulfill their obligations when your family needs to file a claim.

Taking the Next Step

If Transamerica sounds like a good fit based on this review, reach out to a licensed insurance agent who sells their products. Have them run quotes at different coverage amounts and explain which health rating you’d likely qualify for based on your medical history.

Come to the conversation prepared with:

- A list of your current health conditions

- Your current medications

- Questions about anything in this review that you’d like clarified

- Information about your budget and how much coverage you want

Most importantly, don’t feel pressured to make an immediate decision. Take your time, gather information from multiple companies, and choose the policy that provides the best combination of coverage, value, and peace of mind for your specific situation.

Protecting Your Legacy

At its core, final expense insurance isn’t really about policies, premiums, or death benefits. It’s about love and responsibility. It’s about ensuring that your final chapter doesn’t create financial burdens for the people you care about most.

Whether you choose Transamerica or another company, taking action to secure burial insurance is one of the most thoughtful gifts you can give your family. It says, “I care about you enough to plan ahead and protect you from this burden.”

You’ve taken time to read this comprehensive review, which shows you’re serious about making an informed decision. Now take the next step: request quotes, compare options, and secure the coverage that will give both you and your loved ones peace of mind.

Your family will thank you for having the wisdom to plan ahead.

Additional Resources

Ready to compare Transamerica with other top final expense insurance companies? Request free quotes from multiple carriers to find the best rates for your age and health profile.

Questions about the application process? Contact a licensed insurance agent who specializes in final expense insurance for seniors at 252-813-2990.

Want to learn more about final expense insurance in general? Check out our comprehensive guide to burial insurance for seniors to understand all your options.

Disclaimer: This review is for informational purposes only and should not be considered legal or financial advice. Insurance rates, policy features, and availability are subject to change. Always review policy documents carefully and consult with a licensed insurance professional before purchasing coverage. The rates shown are examples and your actual premiums may differ based on your specific circumstances.